The United States is enjoying one of the longest economic expansionary periods in history. Interestingly enough, that’s occurred without the influence of inflation, one of the enduring conundrums for the Federal Open Market Committee. Nevertheless, it appears that expansion is beginning to accelerate – and that has brought about increased concerns over inflation.

In general, commodities benefit from inflationary pressures. Moreover, institutional investment increasingly invests in commodities as a hedge against inflation when inflation begins to appear on the horizon. All that should be good news for the ag sector. Meanwhile, though, grain prices have been pressured in recent years by large global stocks.

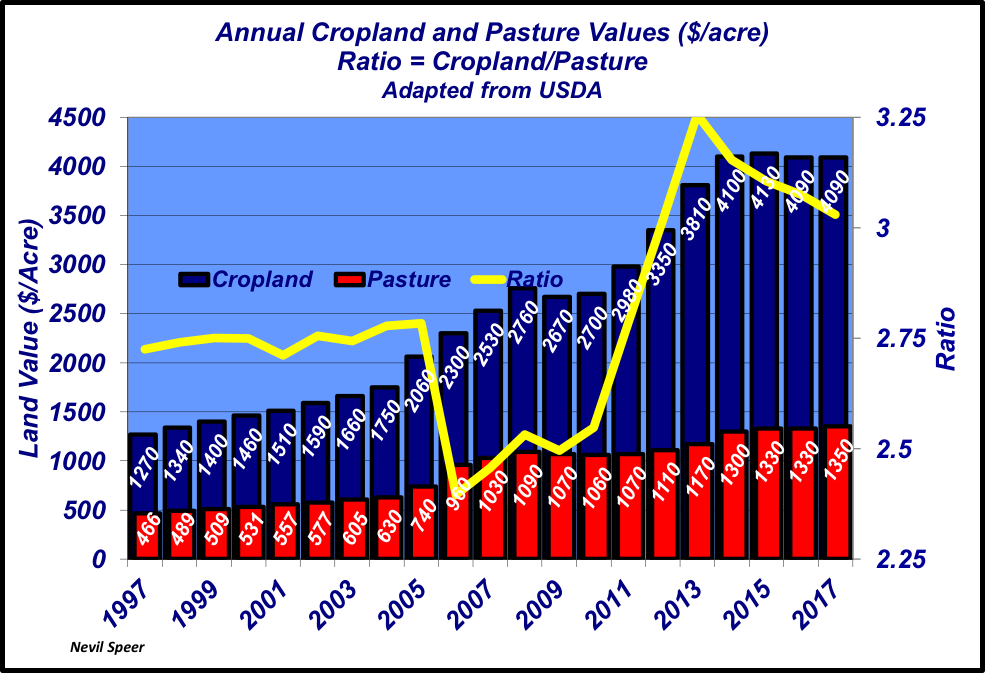

That tug of war is especially important as it translates to land prices. USDA’s most recent land value survey revealed that 2017 was yet another year of stable prices. In other words, ag’s balance sheet hasn’t changed much in recent years as a result of real estate.

Given the consideration of a growing economy and a general outlook for more inflation going forward, that could begin to change in 2018. That may mean land values begin marching higher once again.

What’s your view of prices for 2018? Is that outlook impacting how you’re making management decisions for the coming year? Are there opportunities to purchase land to grow your operation in your area? Leave your thoughts in the comments section below.

Leave A Comment