If you manage a ranch, it’s likely you know your way around operating ratios and profit summaries, but these don’t tell you very much about where to look for problems or improvements. Yet measures exist that can.

While the direct expenses of cow-calf production, such as purchased feed, mineral and vet, have certainly changed over time, the indirect costs of operating the ranch have soared to new heights.

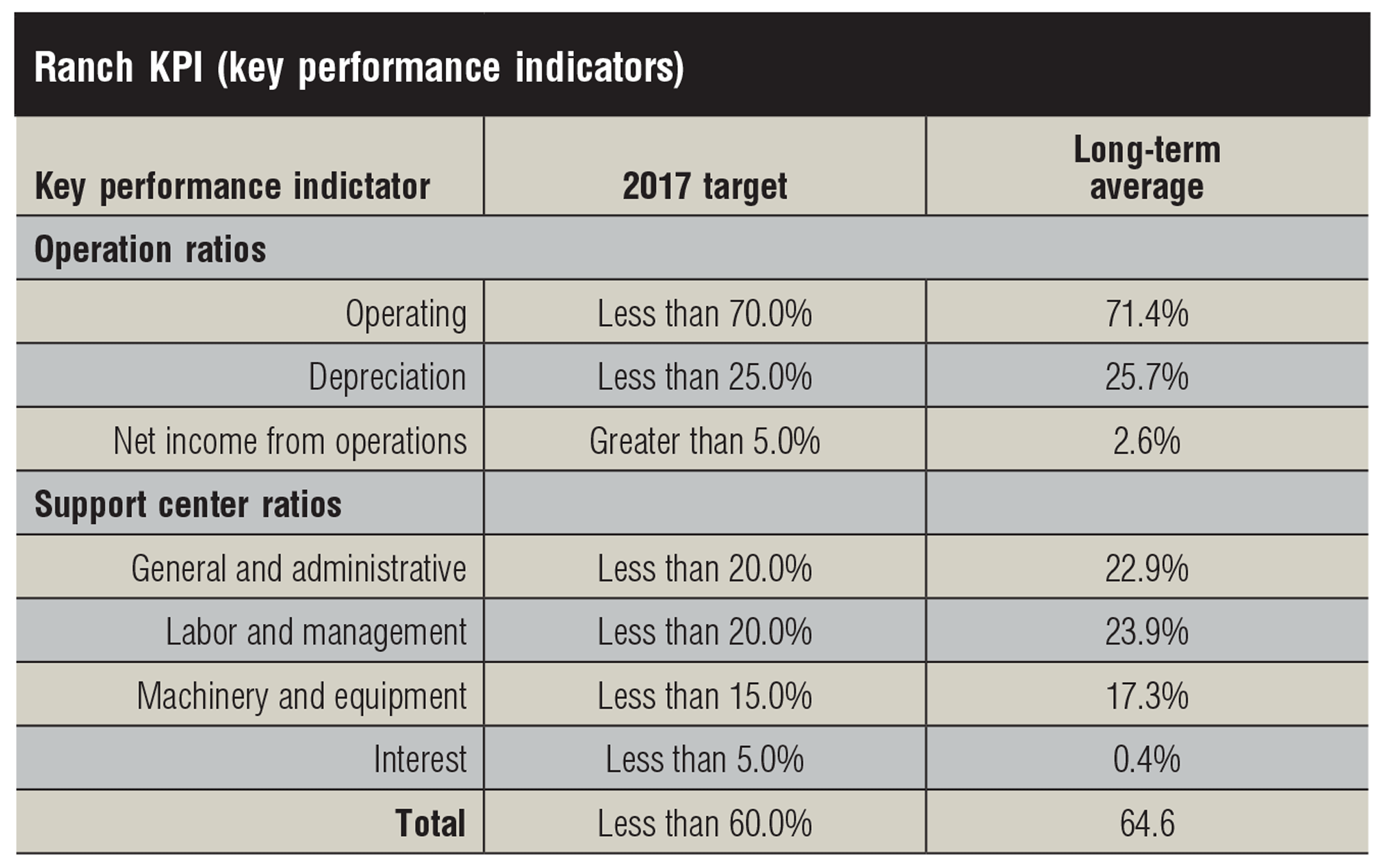

These are the same costs often referred to as fixed costs or indirect costs. These are often considered inflexible spending categories and can be the hardest to change among the expenses ranch managers face. Yet they consume 65 cents of every dollar the average ranch brings in, says Stan Bevers, a private consultant who uses key performance indicator (KPI) numbers in his work.

“An entire beef industry has been created to assure and/or increase the productivity of breeding cows,” Bevers says. “Yet, most recent data sets and studies have pointed to a maximized production plateau that is highly dependent upon the amount of moisture the ranch receives.

“At the same time, the costs to maintain a breeding female, and subsequently to produce and wean a calf, have increased dramatically. Over the past 30 years, annual cow costs have risen from under $400 per female to over $850 per female in 2016,” he says. Specifically which expenses have increased and are fundamentally responsible for the increase should be alarming for ranchers, he adds.

Bevers spent his career working with the Texas A&M AgriLife Extension Service and implementing the Standardized Performance Analysis for scores of ranches in Texas, Oklahoma and New Mexico. Bevers retired from Texas Extension in 2016 and began creating KPIs for his ranching customers.

Speaking specifically about ranch overhead costs, Bevers explains these indirect costs are actually problematic for many of the large ranches he consults with, and not just in Texas or the Southwest. The average of the ranches in his database is 1,500 cows, with some having many more cows and some fewer cows. Many are large, corporate-owned ranches, which should capture any benefits of size, if there are any to be had.

A set of KPIs that Bevers uses are called the “support center ratios.” These break the fixed, or indirect, ranch costs into four easily identifiable categories:

- General and administrative

- Labor and management

- Machinery and equipment

- Interest

You can see how things are broken out for this method of accounting in the category boxes with this story. While labor and management are not typically included in the fixed costs, Bevers sees these four groups providing the base of any ranch.

The biggest problem area, and a growing one, is the cost of labor and management, says. “About 70% of the time, when ranches have an expense problem, it’s labor and management. It just keeps creeping up.”

Bevers says ranch managers claim if they don’t pay high wages, provide benefits and give bonuses, their good employees will go to work for a neighboring ranch. Furthermore, Bevers says the salary and benefit package expectations of new young hires have begun to exceed what a ranch may be able to pay. The ability to identify just where a ranch lies with this KPI is an advantage of the support center ratios Bevers uses.

A distant second among the problem issues in ranch fixed costs is interest expenses, although that is probably 5% to 10% of operations, Bevers believes.

A distant second among the problem issues in ranch fixed costs is interest expenses, although that is probably 5% to 10% of operations, Bevers believes.

The take-home lesson from Bevers’ KPI data is that 65 cents from every dollar earned in ranch income is burned up by indirect costs, and it’s getting worse. That leaves only 35 cents of every dollar earned to pay direct costs and/or make a profit — arguably a narrow window that explains why Bevers has long called cow operations asset-management businesses.

Finally, these KPIs need to be used during the ranch planning process, he says. As most market analysts have predicted, cattle prices are expected to move lower over the next couple of years as beef production increases. Obviously, this will result in lower ranch revenue. If indirect expenses are not lowered, which is very difficult to do, the support center ratios will increase over the next couple of years. This will occur unless ranchers begin to take steps to either increase their revenue (against lowering prices), or decrease their expenses.

To sit back and do nothing will ultimately result in a difficult financial situation for the ranch, Bevers warns.

Interest ratio

Calculation: total interest paid divided by total revenue

Goal: less than 5% of total revenue

Discussion: This support center aggregates the total interest paid on liabilities of the ranch. This would include interest on operating notes, short-term purchase of assets such as stocker cattle, or long-term mortgage liabilities. While a little Interest can be a good thing, a large amount of interest can financially bring down any ranch. It is important to determine the total amount of interest paid by the ranch.

General and administrative ratio

Calculation: total general and administrative expenses divided by total revenue

Goal: less than 20% of total revenue

Discussion: It is common to believe that this support center is a miscellaneous support center, but that is not the case. G&A typically amasses the expenses from the overall operation, but is not associated with labor and management, machinery and equipment, or interest.

Typical expenses sent to G&A would include professional fees such as accounting, legal or consulting; liability insurance; and supplies. Further, any expenses that are associated with buildings and improvements would be classified as G&A. These expenses would include fence repair, building repairs, building and improvement depreciation, and property insurance associated with buildings and improvements.

Support centers can have some revenue: Insurance proceeds, such as drought insurance, would be classified as G&A.

Labor and management ratio

Calculation: total labor and management expenses divided by total revenue

Goal: less than 20% of total revenue

Discussion: Throughout the year, as the ranch pays its employees, the ranch would categorize the check written to salaries, wages, payroll taxes and so forth. The point here is to isolate all expenses associated with the labor and management of the ranch. Most of these expenses are obvious, but some are not.

A few that are not so obvious would be utilities paid for employees’ housing, the board of directors’ travel costs to attend a board of directors meeting, employees’ meals, and contract labor. L&M is one of the largest and most variable across ranches.

Machinery and equipment ratio

Calculation: total machinery and equipment expenses divided by total revenue

Goal: less than 15% of total revenue

Discussion: All expenses associated with vehicles, machinery and equipment would be isolated to this support center. The majority of the expenses would be fuel, repairs and maintenance, insurance, and supplies.

Two sets of transactions that are not common throughout the year would be M&E depreciation and the gain or loss associated with the selling of these assets. This suggests that support centers can have revenue, although it probably would not be a large amount.

Newport is editor of BEEF’s sister publications Beef Producer and BEEF Vet.

Leave A Comment