By Deb VanOverbeke

Beef quality continues to improve in the United States, in no small part due to efforts by U.S. cattle producers who recognize their role in the process of delivering safe, wholesome and delicious beef to the world’s beef consumers. This became evident to those of us who were investigators in the 2016 National Beef Quality Audit (NBQA). Still, there are ways producers can step up to improve quality. More on that later.

First, some background: Over the past 25 years, the checkoff-funded NBQA has delivered a set of benchmarks and measurements for cattle producers and others to help determine quality conformance of the U.S. beef supply. In the beginning, researchers focused on physical attributes, such as marbling, external fat, carcass weight and blemishes.

As we saw more and more success in dealing with these issues through the years, the research was expanded. Now, attributes like food safety, sustainability, animal well-being and the growing disconnect between producers and consumers — all issues that have increased impact on how animals are raised and the beef cattle industry is managed — are included.

The 2016 NBQA provided this information through three major elements: face-to-face interviews; extensive in-plant research, including transportation, mobility, harvest floor and cooler assessments; and a strategy session attended by individuals representing every sector of the beef industry to assess the results and discuss implications.

In the in-plant research, of interest to producers may be the results on carcass bruising. The incidence of bruising was higher in the 2016 study than in the previous 2011 audit, but the severity of bruising was less. We also found that fewer cattle had brands and more cattle were free of horns.

The mobility of cattle getting to the packing plant was excellent: 97% of cattle received a mobility score of 1, with the animal walking easily and normally, with no apparent lameness.

Other findings of note

Food safety is still a huge quality factor. Many respondents in the face-to-face interviews, in fact, said it was more than just important — it was implied as a requirement of doing business.

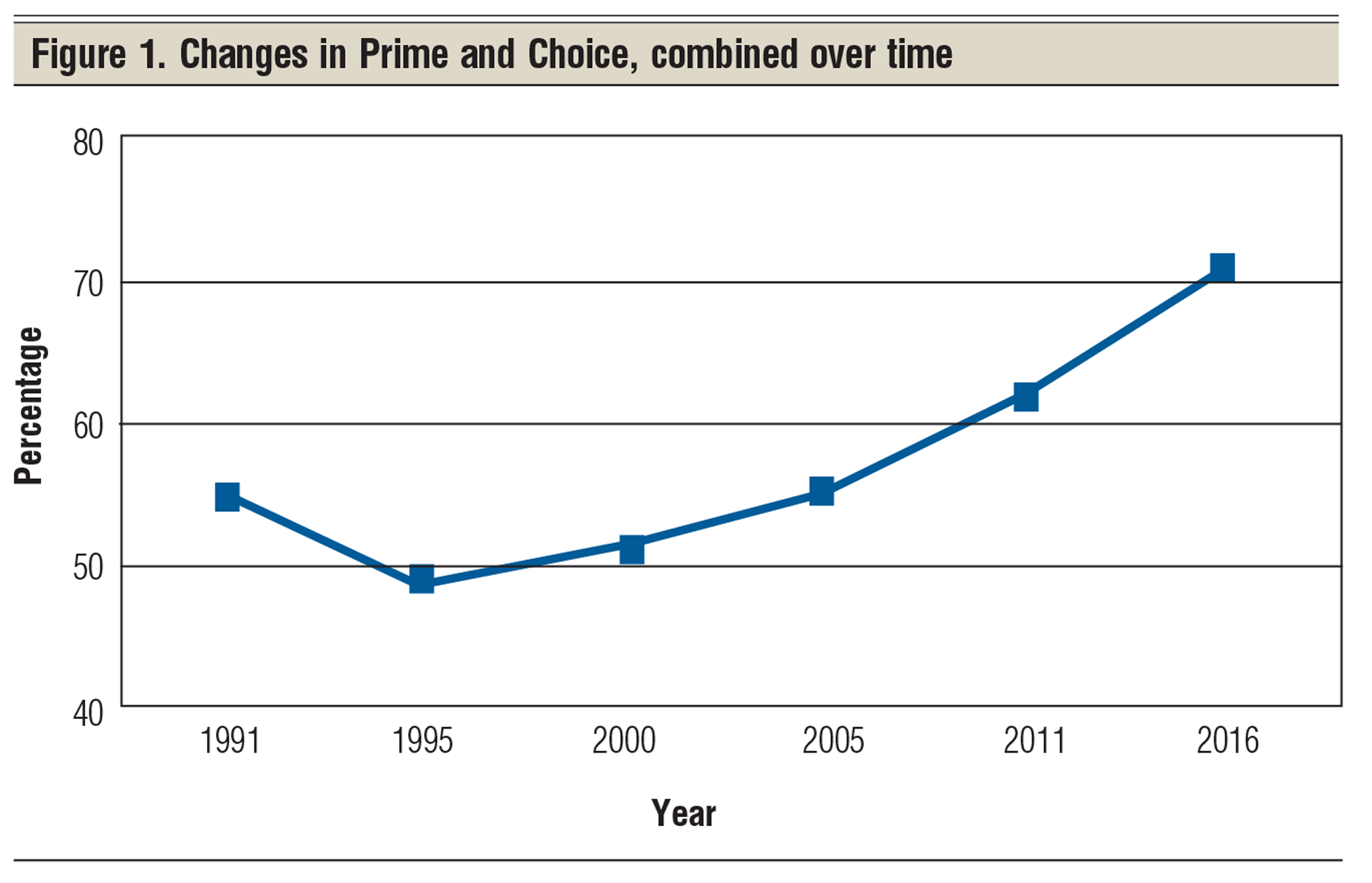

There was a dramatic increase in the frequency of Prime and Choice, and a decrease in the frequency of Select. (Figure 1.) One of the reasons for this is the increase in dairy-type carcasses. While the greatest proportion of carcasses were within the lowest third of the grade for Choice and Prime, most carcasses qualifying for Select were in the top half of the grade.

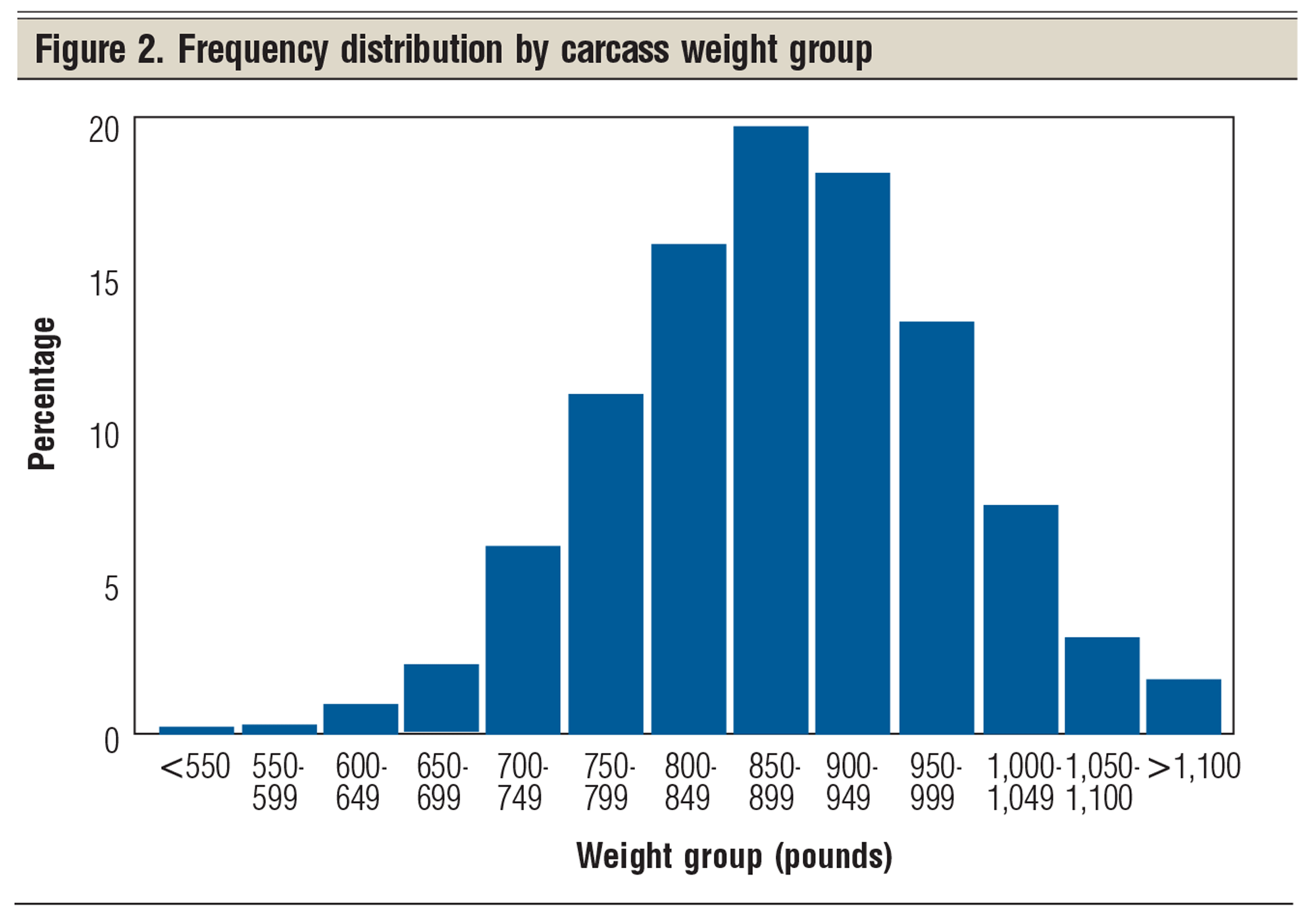

Quality improvements are being accompanied by increases in fatness and size. In-plant research shows there has been a continual increase in hot carcass weight (Figure 2), and because it costs as much to harvest a small animal as a large one, packing plants benefit from larger animals (to a point). Attention to genetics that would reduce fatness and improve yield while maintaining quality gains could lead to significant benefits throughout the chain.

Some of those interviewed in face-to-face interviews also voiced concerns about the size inconsistencies of beef subprimals. They are nervous about consistently meeting customer specifications for thickness and weights. Consumers generally prefer thicker steaks with a smaller surface area; larger carcasses can result in a steak with an undesirable surface area for many consumers.

Tenderness and flavor continue to be the two beef quality factors driving customer satisfaction; and while quality was seen as a strength in the steer and heifer sector of the industry, the lack of process transparency was seen as a weakness among retail and food service company representatives.

There was a decrease in black-hided cattle and an increase in Holstein-type cattle compared to the NBQA 2011: 57.8% vs. 61.1%, and 20.4% vs. 5.5%, respectively.

The number of blemishes, condemnations and other attributes that can have an impact on animal value remains small, and industry efforts to address these issues since 1995 have been generally encouraging.

A review of instrument grading, representing more than 4.5 million carcasses over a one-year period, provided results similar to those observed through in-plant research. This gave confidence to the increasingly prevalent assessments provided by instrument grading throughout the industry. The trends echoed those observed in 2011.

Based on the results of the in-plant and interview research, beef industry participants at a December strategy session derived three key areas for focused improvement: food safety and animal health; eating quality and reduction of variety; and optimizing value and eliminating waste. This allowed them to focus their proposed actions more directly on industry needs.

Among the ideas for food safety and animal health were implementing information-sharing systems; improving uptake of preventive health strategies and good cattle husbandry techniques; and continuing efforts to improve supply chain safety interventions.

To improve eating quality and reduce variety, session participants recommended more measurable information systems and supply chain coordination; research and genetic strategies to improve eating satisfaction; use of advancements in genetic selection technologies for better cattle breeding; and implementation of refined sorting strategies.

Information-sharing systems were also recommended for optimizing value and eliminating waste, as was increasing industry-wide adoption of proven genomic technologies to improve desirable traits more quickly.

Session participants were adamant about creating greater education and communication of BQA to the supply chain and consumers. It was agreed that increased certification of those who follow BQA practices could enhance respect for both the program and the industry.

The bottom line

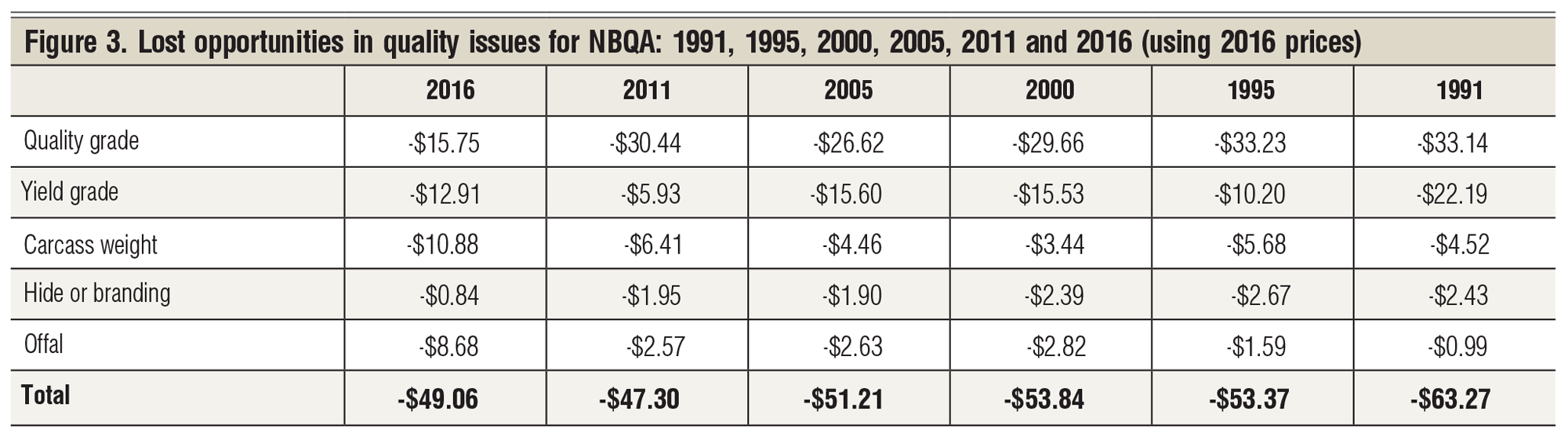

After each NBQA, the lost opportunities for the industry are calculated to suggest areas where producers and others can make improvements to increase profitability. Because prices are sometimes not reported or changes in data collection occur, precise calculations can be hard to come by. However, the total lost opportunities for 2016 and previous audits — adjusted to 2016 prices — are noted in Figure 3, and provide some good guidance as we look for areas of improvement.

These data and other research show the beef industry has spent the last quarter-century significantly improving the quality of its product. While there’s no denying there is always room for improvement, the data also show that those in the industry have a valuable story to tell. It doesn’t help that many in the industry don’t fully know the best way to tell it.

Using BQA and its principles to increase consumer confidence and enhance industry commitment would lead to greater beef demand and improve industry harmonization. Carrying this BQA message throughout the industry would benefit every audience.

The full executive summary and more information about the 2016 NBQA and previous audits can be found on the Beef Quality Assurance website at bqa.org.

Scope of the 2016 NBQA research

- Face-to-face: Interviews were conducted with 194 representatives of the different market sectors (feeders, packers, retailers, food service operators and allied industry or government employees) in 2016 to help determine how quality categories are defined, and establish the relative importance for those qualities.

- In-plant: About 8,000 live cattle at 17 U.S. beef processing facilities were evaluated for attributes related to transportation, while 24,600 — about 10% of a day’s production at the plants — were evaluated for characteristics that determine quality and value, including quality, yield grade, weight and marbling, In addition, 9,100 carcasses were evaluated in 30 processing facilities to assess characteristics that determine quality and value, including quality, yield grade, weight and marbling. These assessments represented about 10% of a day’s production at the facilities.

- Instrument grading: In 18 processing facilities, data were reviewed that represented more than 4.5 million carcasses. One week’s worth of data each month was used over a one-year period, including information on grade, gender, breed type, marbling score, defects, fat thickness, loin muscle area, hot carcass weight, and the fat percentage of kidneys, pelvises and hearts.

- Strategy session: Held in December 2016, more than 70 individuals representing every sector of the beef industry reviewed results of the research and discussed industry implications, providing strategic guidance to the industry for the next five years.

- Online producer survey: In late 2016, 809 producers reacted to various industry terms, providing additional context to the NBQA research.

VanOverbeke is assistant dean, academic programs, for the College of Agricultural Sciences and Natural Resources and George Chiga Endowed Professor in Animal Science at Oklahoma State University. She was one of the principal investigators in the 2016 National Beef Quality Audit.

Leave A Comment