Last week’s Industry At A Glance featured five-year reproduction benchmarks from North Dakota State University. The data was derived from NDSU’s Cow Herd Appraisal Performance Software (CHAPS) Extension outreach. Accordingly, the discussion highlighted CHAPS benchmarks (2003-2017) from a recent long-term assessment by the Extension team.

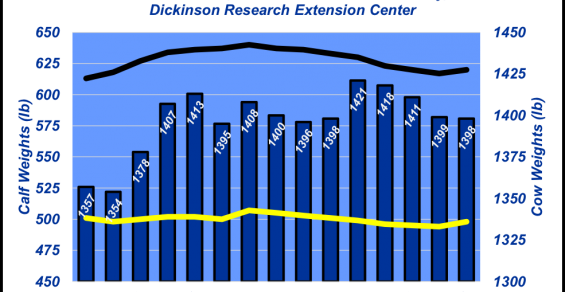

This week’s illustration provides a different perspective. That is, the data reflect production (calf weights and cow weights) trends over time. A couple of things are worth noting.

First, not surprisingly, cow weights have increased over time. That is, weights in 2017 are bigger than they were in 2003. However, the biggest jump came about 10 years ago—cow weights, though, have since plateaued. Second, weaning weights have barely nudged albeit with a slight increase. And lastly, the key measure of pounds weaned per cow exposed has remained flat.

As such, the trends are largely in line with last week’s review around reproduction traits. That is, the cowherd has not changed very much in terms of its productivity. That has some important ramifications, especially when considering many anecdotal observations that commonly occur around cowherd productivity. Moreover, it should also be noted that these trends are right in line with previous coverage of the Kansas Farm Management Association trends. For more on this see: Cowherd Trends are Locked and Loaded.

And as noted last week, in both cases, (North Dakota and Kansas) the data are likely reflective of what’s occurring across the rest of the country. Perhaps even more important, we’ve also witnessed the cowherd making an important contribution to the overall improvement in beef quality, without sacrificing production—thereby shoring up beef demand and pricing power over time.

How do you perceive these trends? Are they in line with your operation? Are they consistent with your perception of what’s occurring in the cow/calf sector? Do you foresee any of these trends changing in the coming years? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

Leave A Comment