By Miriam Martin

Fall is in full glory and for many, that means weaning time for spring-born calves. But then what? Will you throw your calves into the height of the fall run, hoping for the best price you can get?

BEEF collaborated with Colorado State University to survey how beef producers are marketing their calf crop and selecting replacements, and what challenges they are facing in 2017. Results show that producers are willing to explore new marketing strategies, and are already marketing their calf crop via many different avenues.

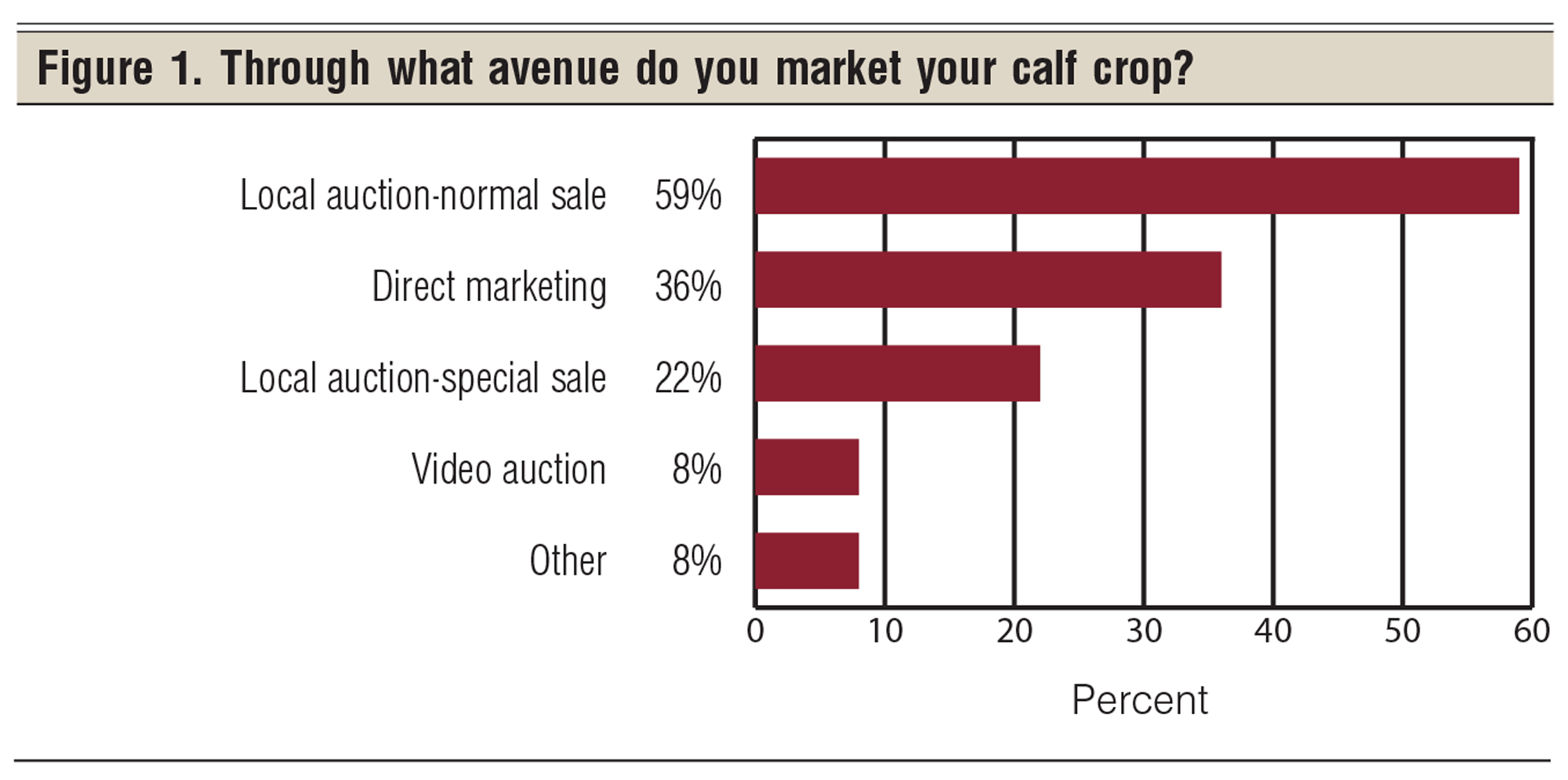

A total of 80.9% of producers are marketing their calf crop through a local auction market, with 22.2% of those producers doing so through a special sale. What’s more, 36.2% are using direct marketing, and 8% are selling via video auction (Figure 1). Figures add up to more than 100% because some respondents market calves through more than one channel.

The respectable numbers for those who use direct marketing and video sales likely reflect a growing interest in vertical cooperation among industry segments, and an effort toward better animal health. The longer calves are in the marketing chain, such as the number of auction markets they travel through and the number of times they are commingled, the greater the risk of health problems.

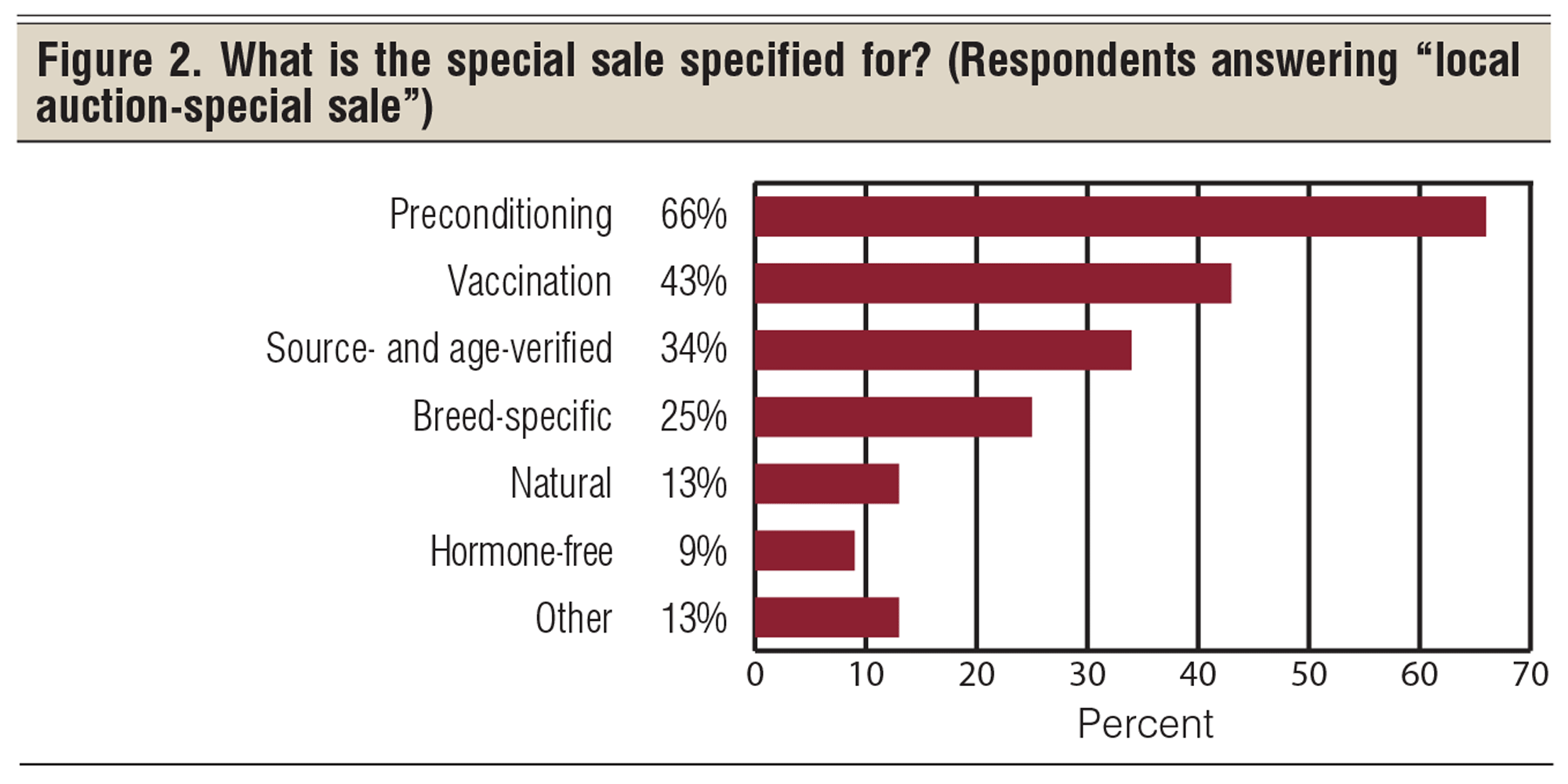

Of the producers who market their calves via special sale, 65.8% market through a sale specified for preconditioned calves. Preconditioned was defined in the survey as weaning and vaccinating calves 45 to 60 days prior to the calves leaving the operation. Beyond that, 43.1% of special sales were specified for a vaccination program, followed by source and age verification and breed-specific sales (Figure 2). Totals add up to more than 100% due to multiple answers.

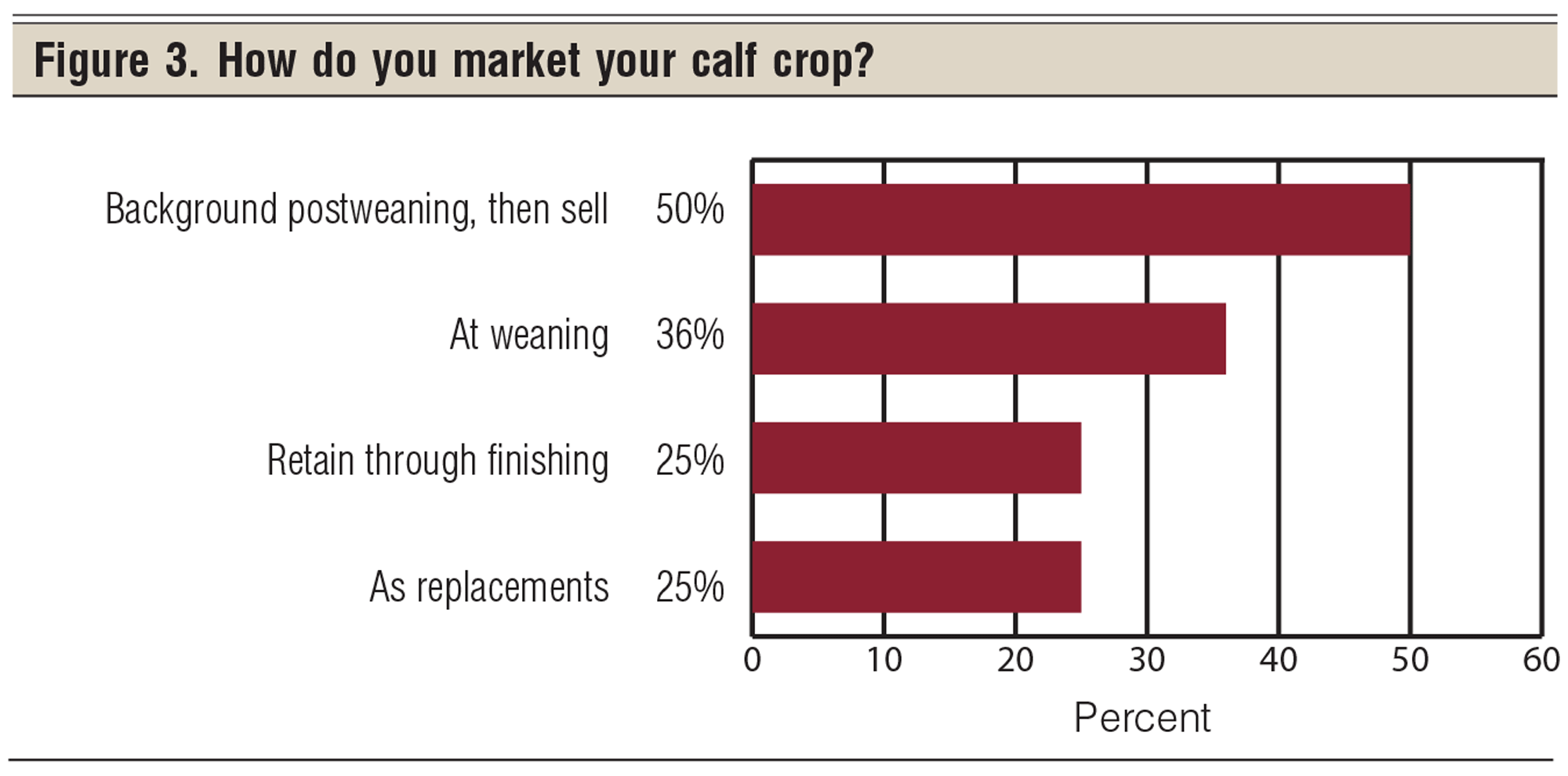

When asked to identify how they market their calf crop, 50.3% of producers are backgrounding their calves postweaning, prior to marketing them, with 24.6% retaining them through finishing. Bowing to tradition, 35.7% of respondents market at weaning, and 24.6% market replacements (Figure 3). Producers who market heifers as replacements and steers at weaning likely checked multiple boxes, meaning totals add up to more than 100% due to multiple answers.

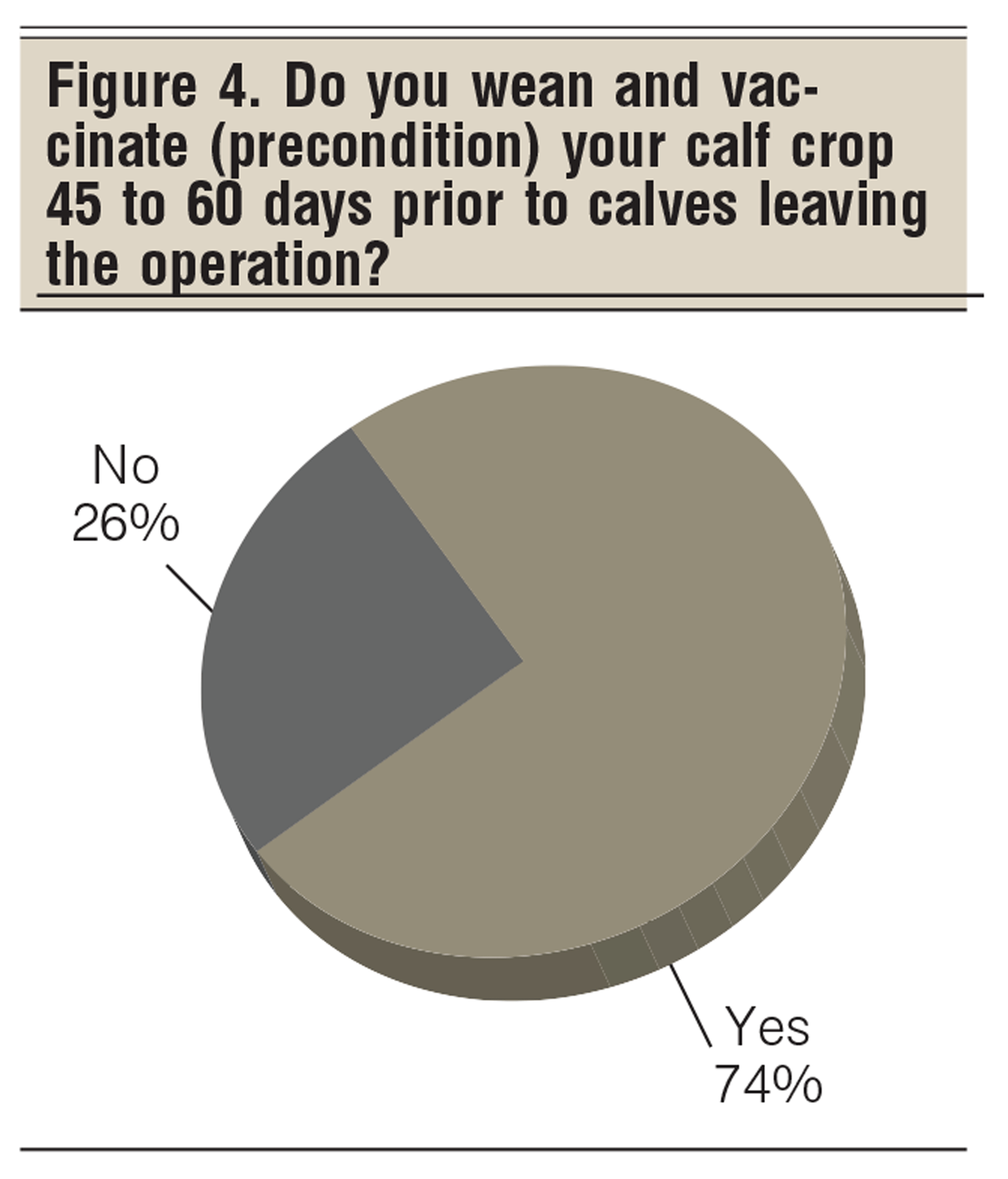

It appears the value of preconditioning, both in dollars and animal welfare, is hitting home with BEEF readers; 74.5% of respondents precondition their calf crop for 45 to 60 days before the calves leave home (Figure 4).

“Preconditioning is a responsibility to our cattle and the future of our industry. Preconditioning decreases the risk of respiratory disease in cattle, which leads to decreased reliance on antibiotics while improving animal welfare,” says Dan Thomson, Kansas State University. “The sustainability and profitability of our farms and ranches will be dependent on all of us properly managing cattle prior to their change of address.”

“Preconditioning is a responsibility to our cattle and the future of our industry. Preconditioning decreases the risk of respiratory disease in cattle, which leads to decreased reliance on antibiotics while improving animal welfare,” says Dan Thomson, Kansas State University. “The sustainability and profitability of our farms and ranches will be dependent on all of us properly managing cattle prior to their change of address.”

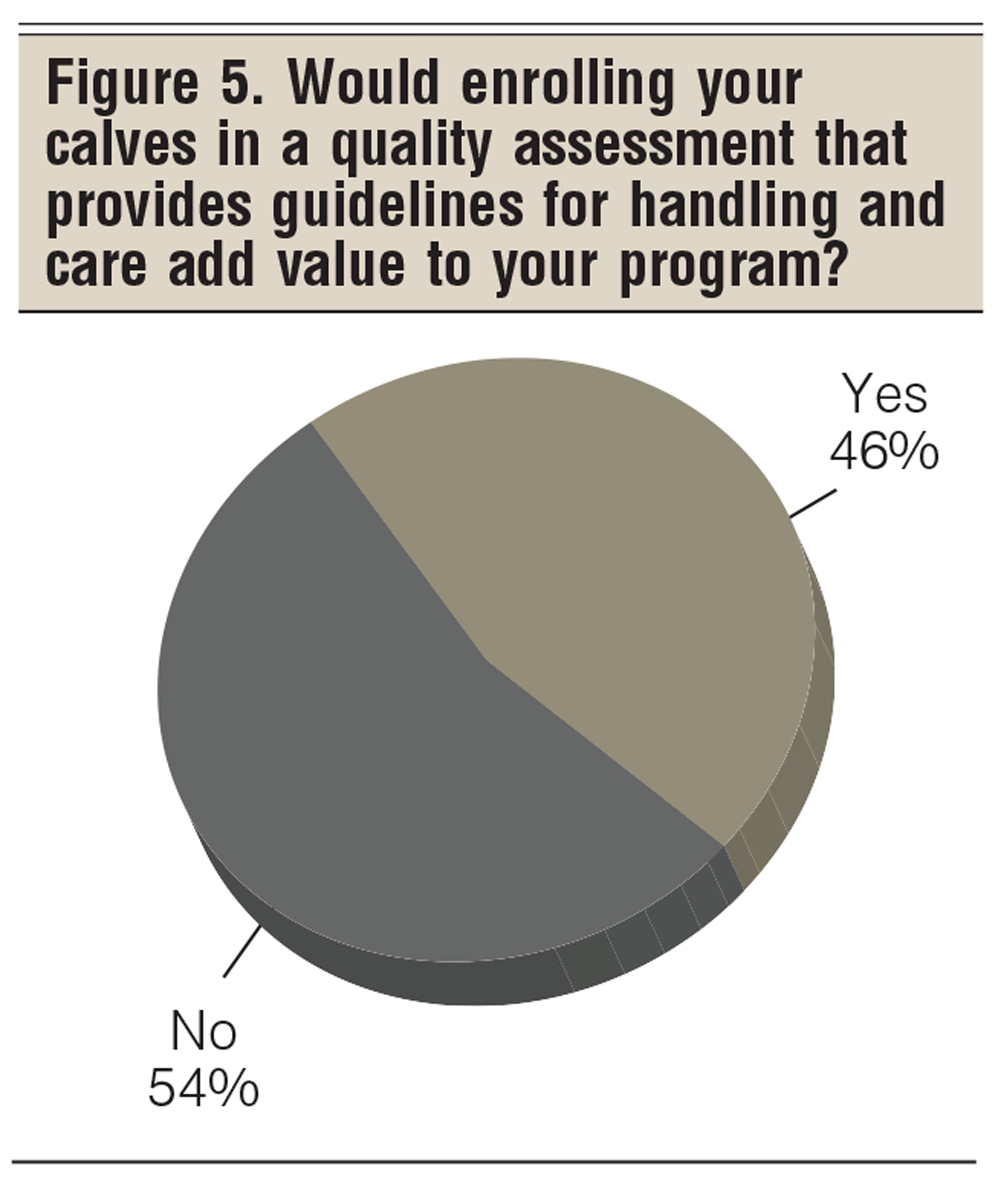

With consumers becoming more interested in how we raise beef, opportunities for programs that verify animal handling and care may add value in the marketplace. When asked about participating in a quality assessment program, 46.3% of producers answered yes, that a quality assessment providing guidelines for handling and care would add value to their program (Figure 5).

In an environment where many different postweaning programs exist to add value, deciding which program best fits the needs of your operation and can add the most profitability to your calf crop can be a challenge. But the potential rewards are worth checking out if a value-added program might benefit your operation.

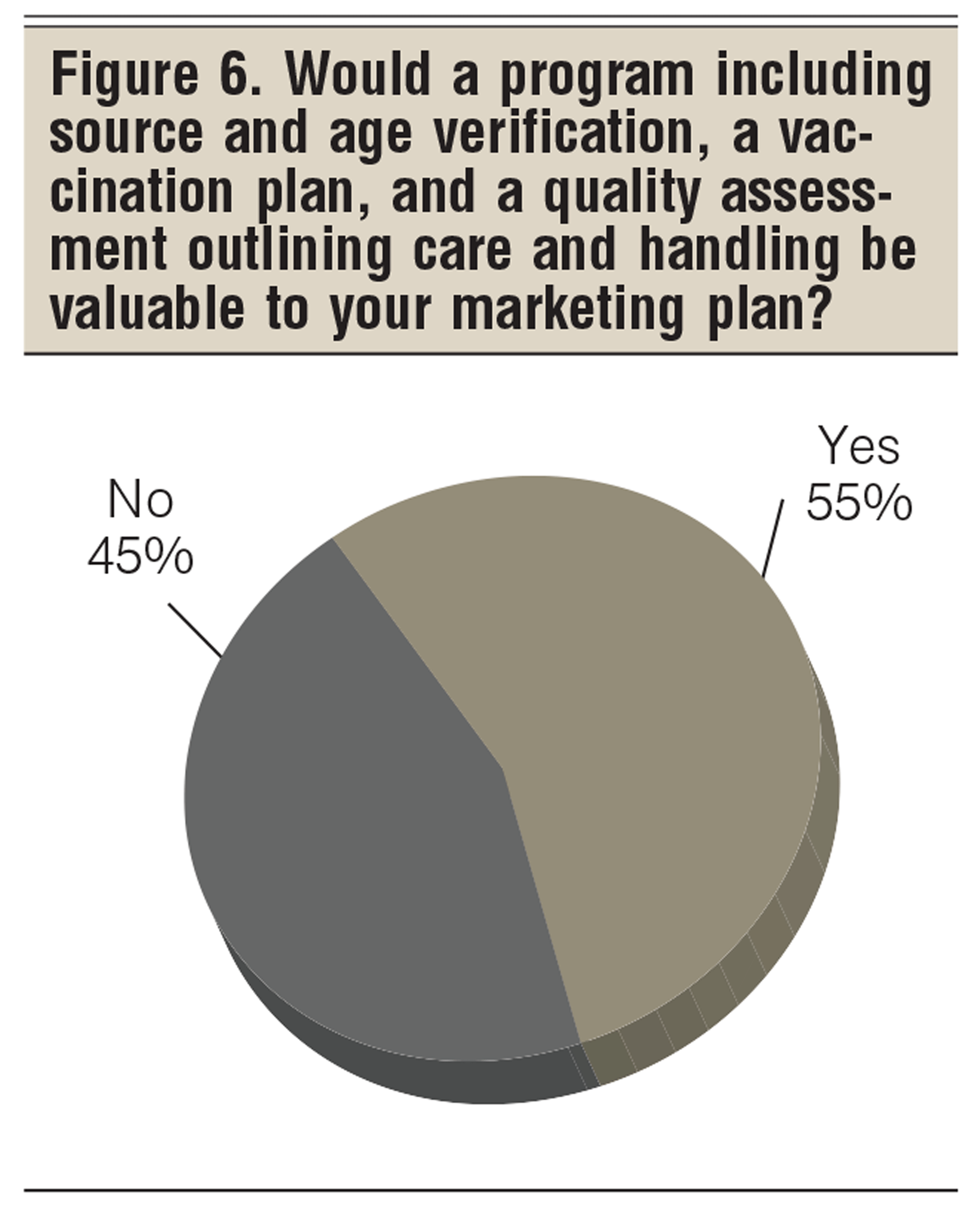

Further exploring the value-added potential of on-ranch management, 54.9% of producers say that an all-inclusive program, verifying source and age, vaccinations, and handling and care, would be of value to their marketing program (Figure 6). Value can change with different certification programs based on the export market, so the concept of “having all your bases covered” is likely attractive to some producers.

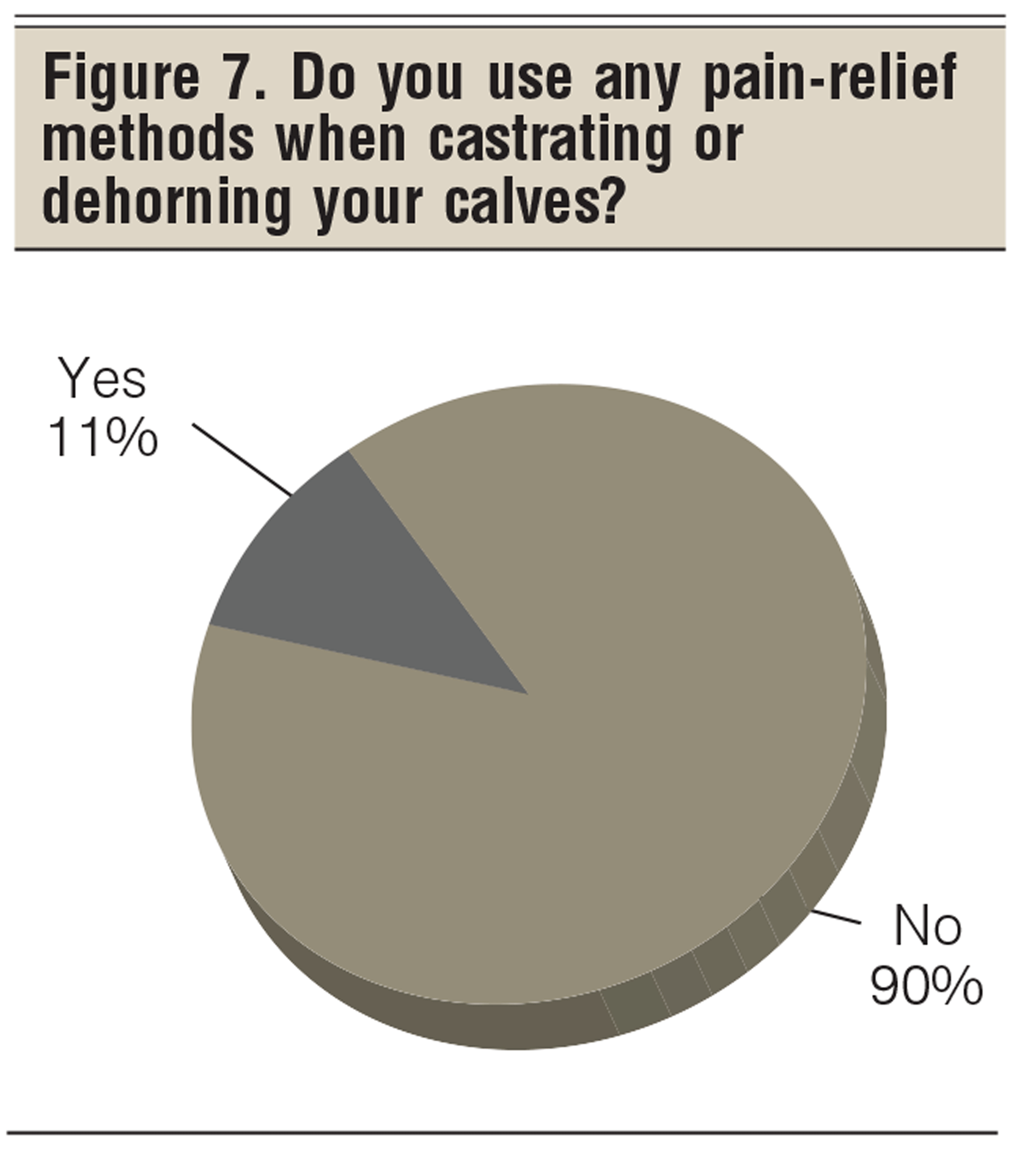

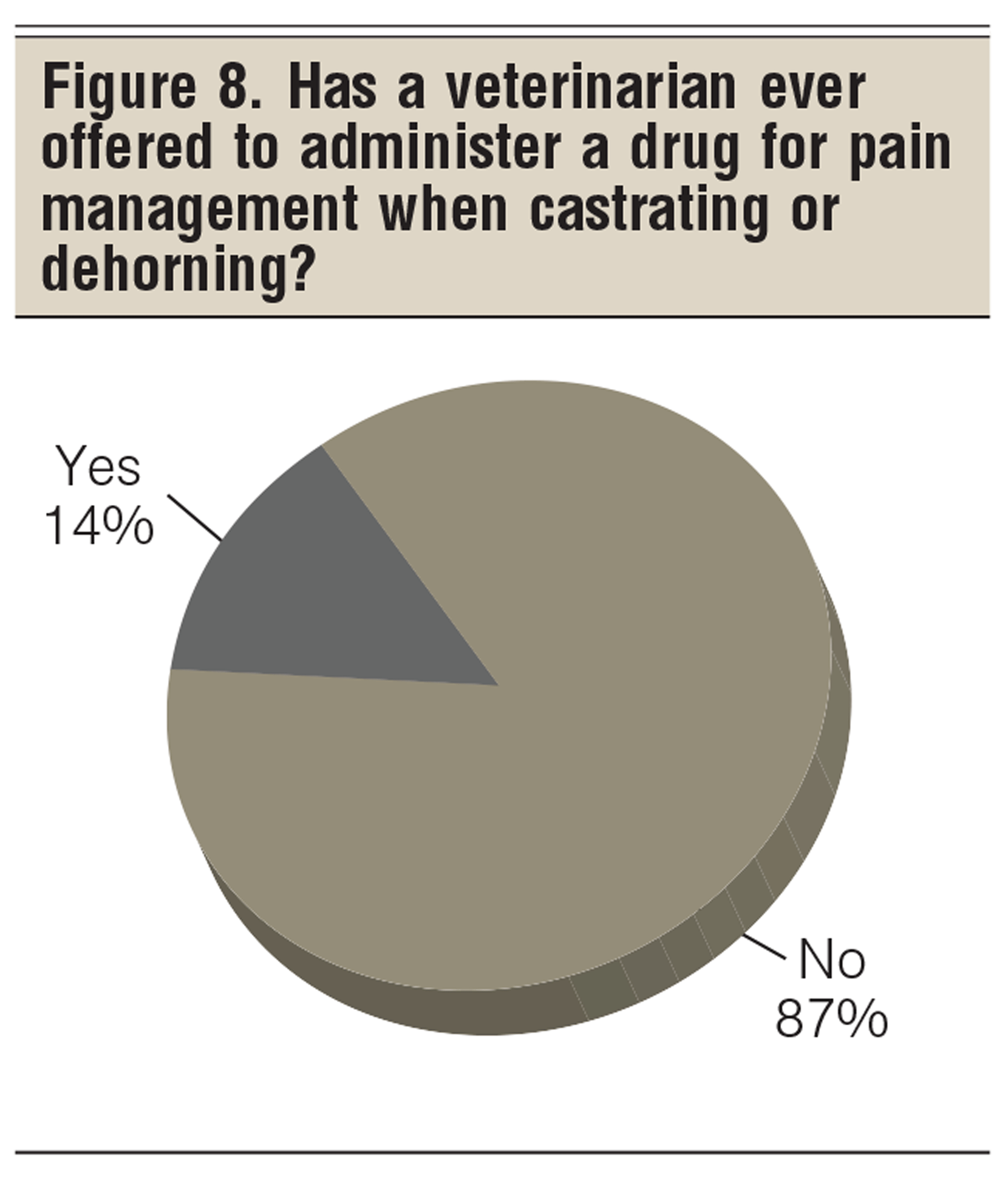

Looking at management practices that may be coming down the road, 10.5% of respondents use pain relief methods when castrating or dehorning (Figure 7). This response seems to correlate with the 13.5% of respondents who say they’ve had a veterinarian offer to administer a drug for pain management (Figure 8).

Looking at management practices that may be coming down the road, 10.5% of respondents use pain relief methods when castrating or dehorning (Figure 7). This response seems to correlate with the 13.5% of respondents who say they’ve had a veterinarian offer to administer a drug for pain management (Figure 8).

Having a conversation with your veterinarian regarding cost and feasibility of pain management techniques may prove valuable to your operation. Pain relief during castration and dehorning is a topic the scientific community has put a great deal of research into, trying to find an effective and practical tool for producers to alleviate pain during certain management procedures.

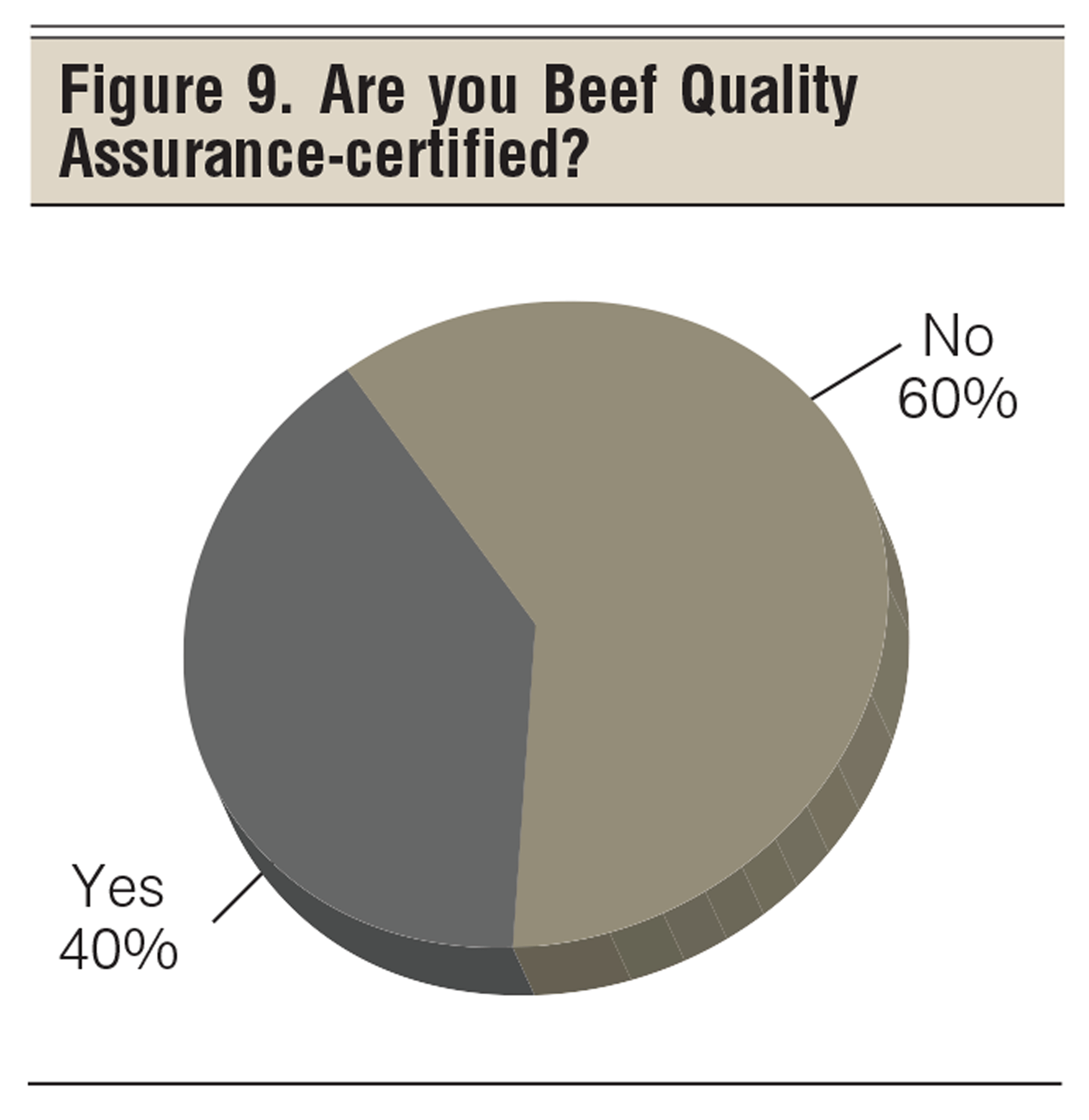

Since its inception, the Beef Quality Assurance program has given beef producers a template on how to do things right. And producers are using it; 39.8% of beef producers say they are Beef Quality Assurance-certified (Figure 9).

Recently released results from the 2016 National Beef Quality Audit point to advanced genetic selection, information-sharing and record-keeping technologies as important for the industry to move forward. The need for better communication between sectors of the industry, a clear traceability program and the need for Beef Quality Assurance to become more of a priority for producers was made clear in the audit results. Through online training modules specified by sector of the beef industry, such as cow-calf, stocker and feedyard, it is easy to become certified in best practices pertaining to your operation.

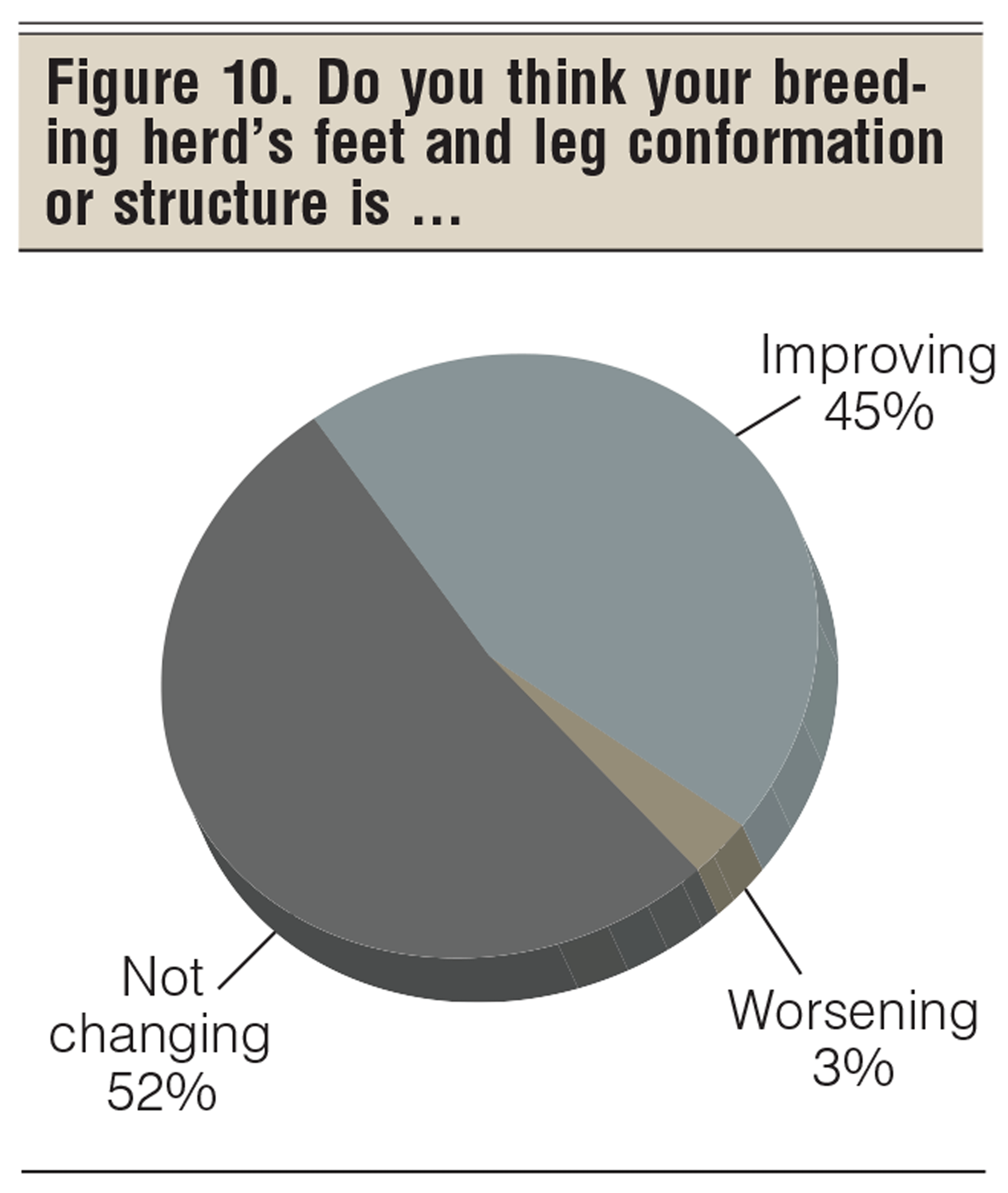

Recent attention on feet and leg structure, particularly in fed cattle, has sharpened focus on structural integrity. When asked about feet and leg structure, 45.2% of producers believe their breeding herd’s feet and leg conformation is improving, with 52% seeing no change, and a very small percentage of producers seeing their herd’s conformation worsening (Figure 10).

Recent attention on feet and leg structure, particularly in fed cattle, has sharpened focus on structural integrity. When asked about feet and leg structure, 45.2% of producers believe their breeding herd’s feet and leg conformation is improving, with 52% seeing no change, and a very small percentage of producers seeing their herd’s conformation worsening (Figure 10).

Reducing lameness in cattle arriving at the slaughter facility, whether as cull cows or fed cattle, is something that starts with the breeding herd — and its seems to be a priority for producers. Through increased selection pressure for better feet and leg conformation, along with culling problem animals sooner, lameness due to genetic causes will continue to decline.

Reducing lameness in cattle arriving at the slaughter facility, whether as cull cows or fed cattle, is something that starts with the breeding herd — and its seems to be a priority for producers. Through increased selection pressure for better feet and leg conformation, along with culling problem animals sooner, lameness due to genetic causes will continue to decline.

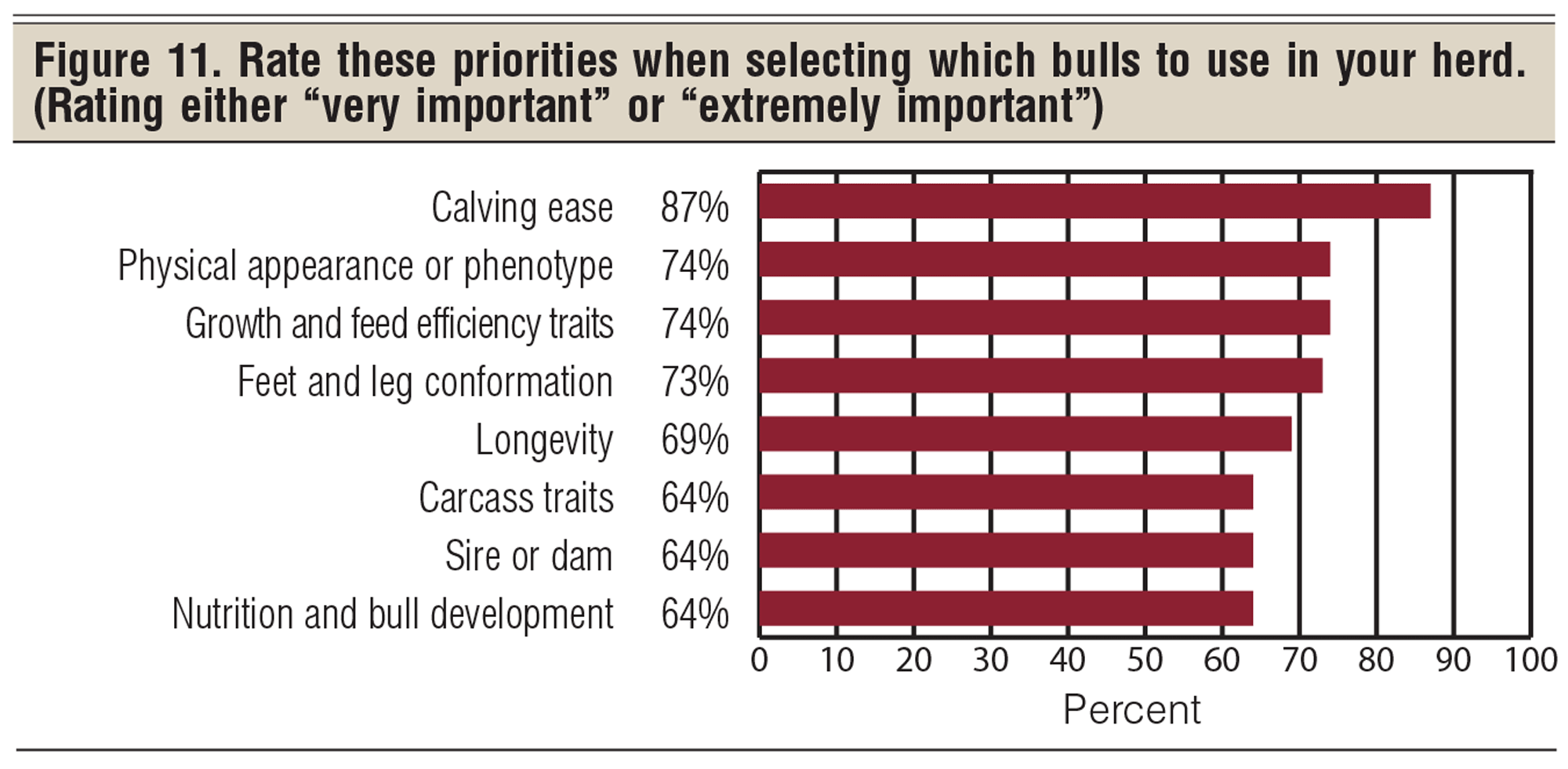

Given that attention to structural soundness, top priorities for producers when selecting which bulls to use were calving ease at 87%; growth and feed efficiency, and phenotype, both at 74%; followed by feet and leg structure at 72.5% (Figure 11). Totals add up to more than 100% due to multiple answers.

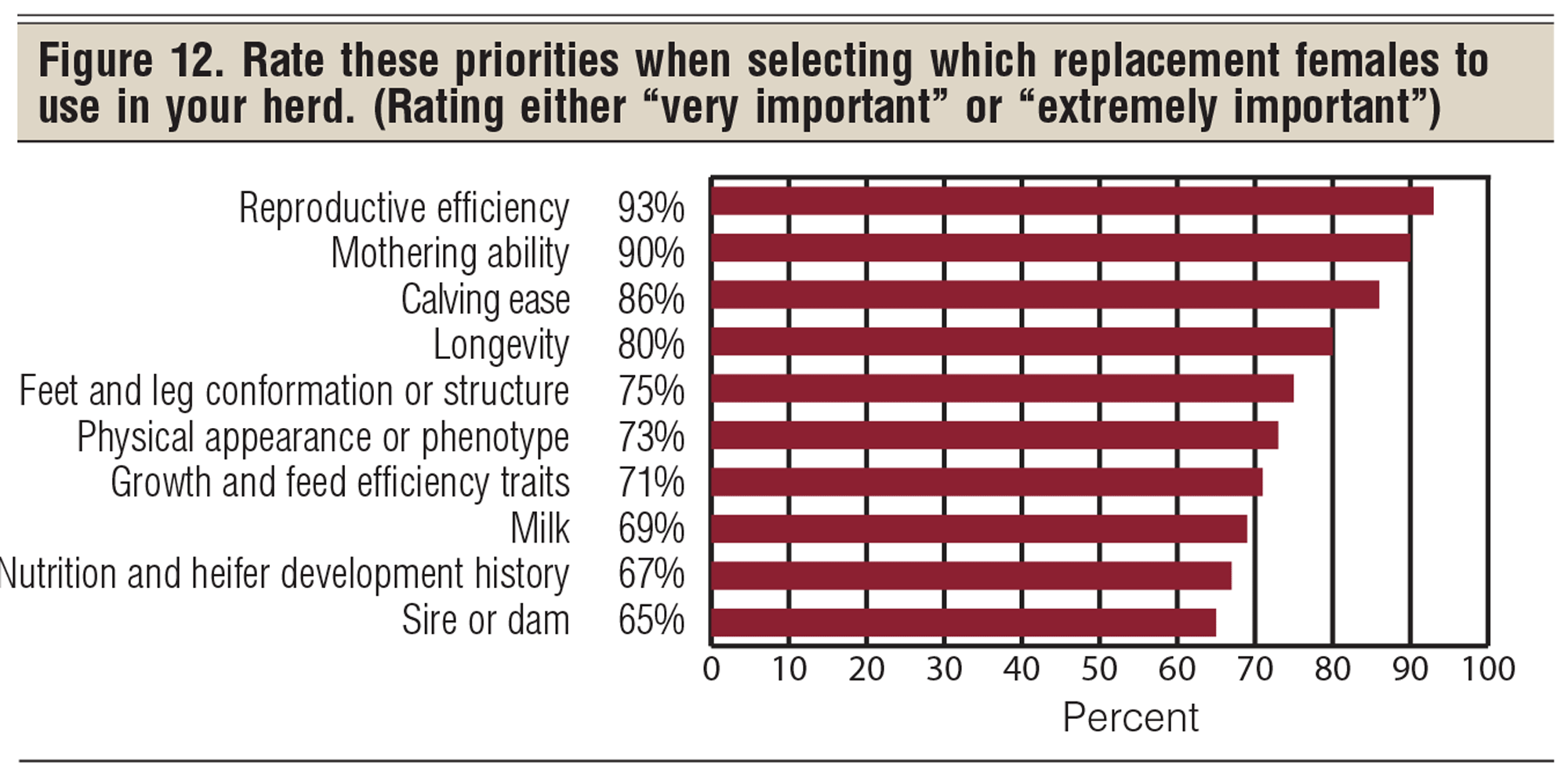

When selecting female replacements, reproductive efficiency was the top priority at 93.1%, followed by mothering ability at 90.3%, Calving ease and longevity were top priorities as well (Figure 12). Selecting animals that meet the needs of your program, can adapt well nutritionally and can acclimate to the weather conditions of your operation is crucial.

When selecting female replacements, reproductive efficiency was the top priority at 93.1%, followed by mothering ability at 90.3%, Calving ease and longevity were top priorities as well (Figure 12). Selecting animals that meet the needs of your program, can adapt well nutritionally and can acclimate to the weather conditions of your operation is crucial.

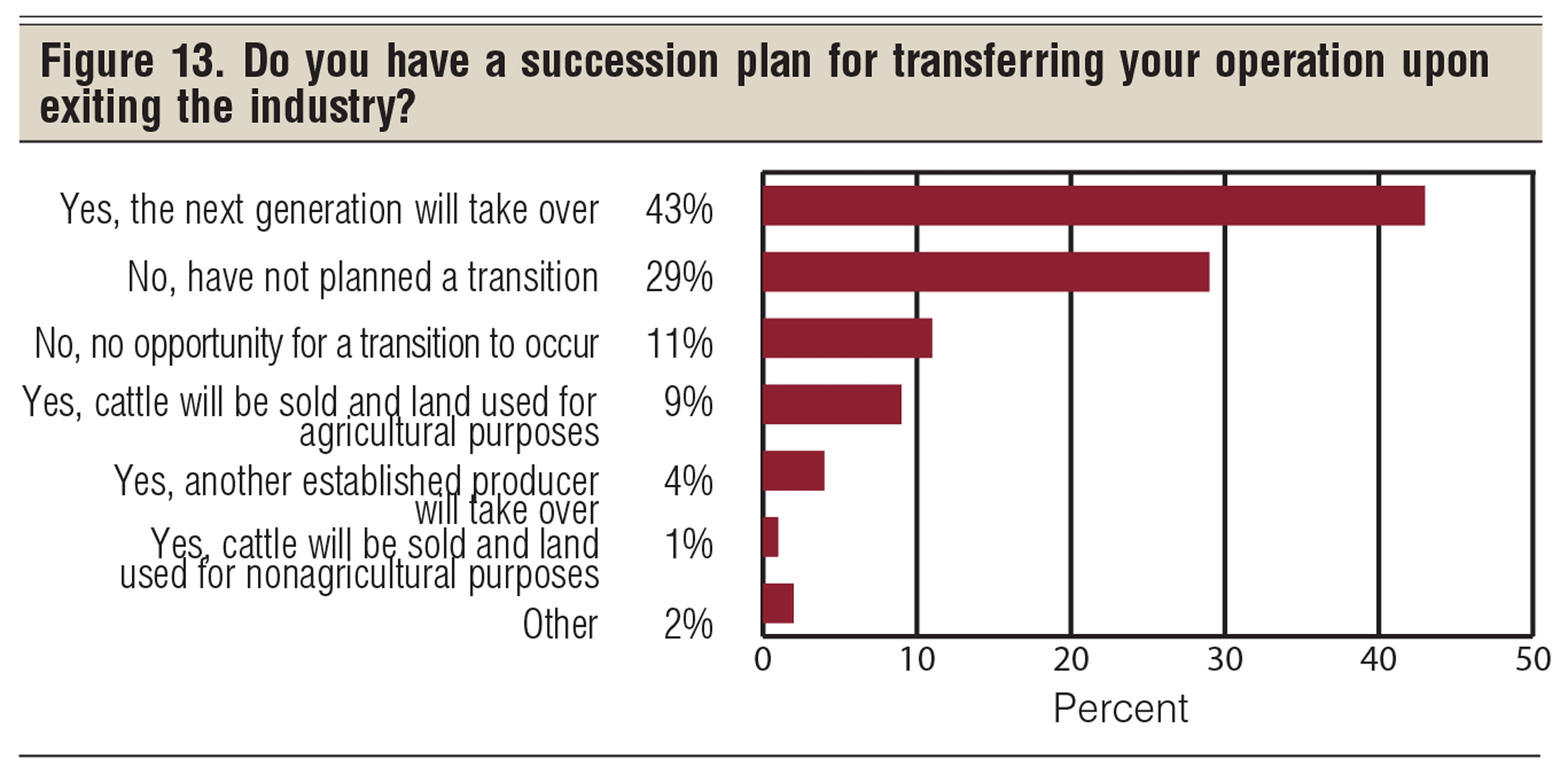

Looking at other aspects of ranch ownership, a total of 56.4% of producers say they have some type of succession plan in place, while 29% have not planned a transition. Another 11.3% responded that they have no opportunity for a transition to occur (Figure 13).

Looking at other aspects of ranch ownership, a total of 56.4% of producers say they have some type of succession plan in place, while 29% have not planned a transition. Another 11.3% responded that they have no opportunity for a transition to occur (Figure 13).

This is a harsh reality — that 11.3% of producers will likely be exiting the business without someone to succeed them. Finding a knowledgeable financial adviser who understands the goals of your operation, and taking the time to plan for the future, are important steps in developing a succession plan.

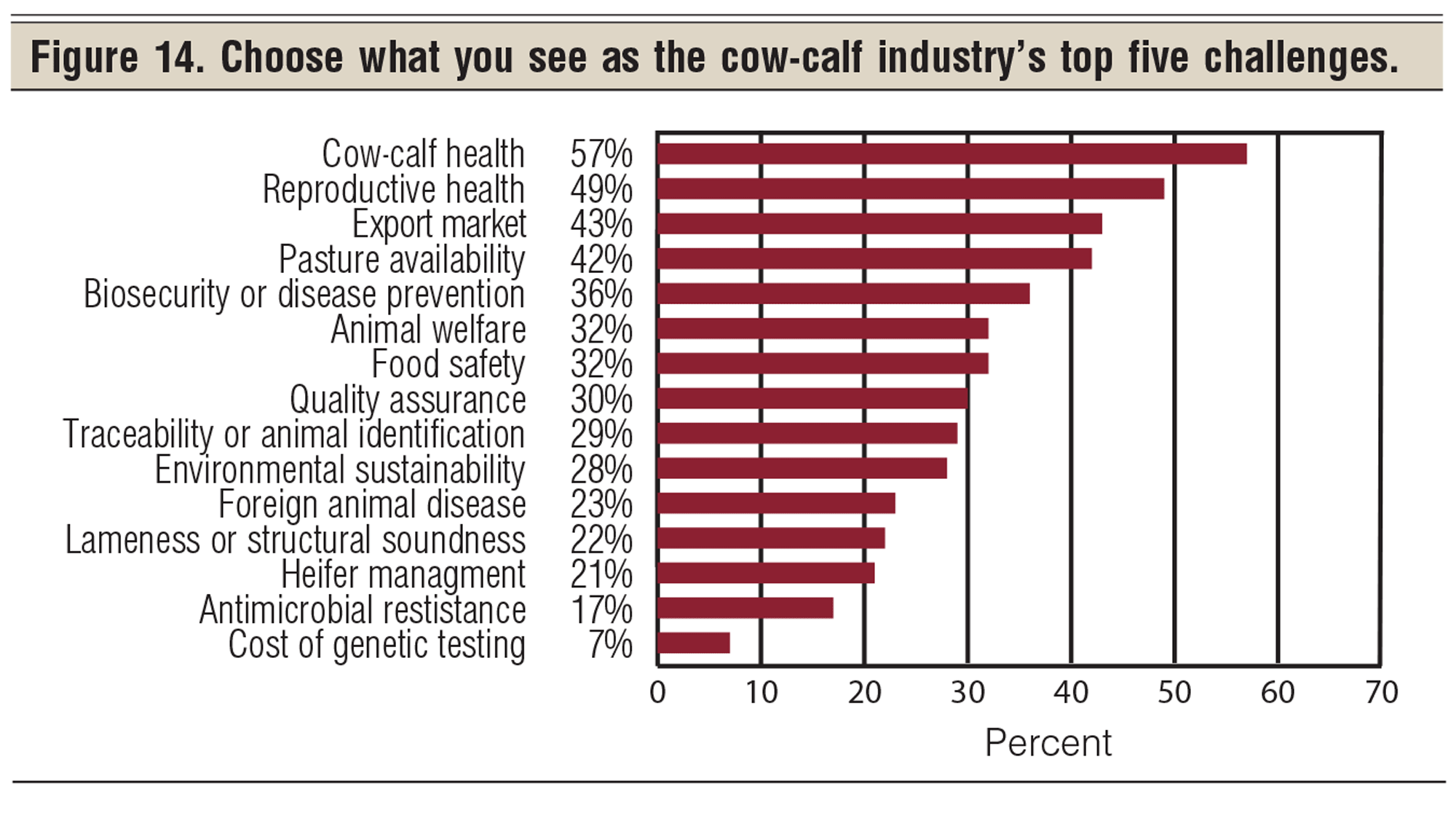

Taking a broad view of the challenges facing ranchers, cow-calf health rose to the top as one of the industry’s top five challenges, followed by reproductive health and the export market. Pasture availability and biosecurity were the fourth and fifth challenges identified (Figure 14).

With three of the top five challenges centered around health and disease prevention, keeping animals healthy and productive seems to be the top priority for producers. The many different factors that play into opportunities for export creates a degree of uncertainty that producers identified as a challenge.

With three of the top five challenges centered around health and disease prevention, keeping animals healthy and productive seems to be the top priority for producers. The many different factors that play into opportunities for export creates a degree of uncertainty that producers identified as a challenge.

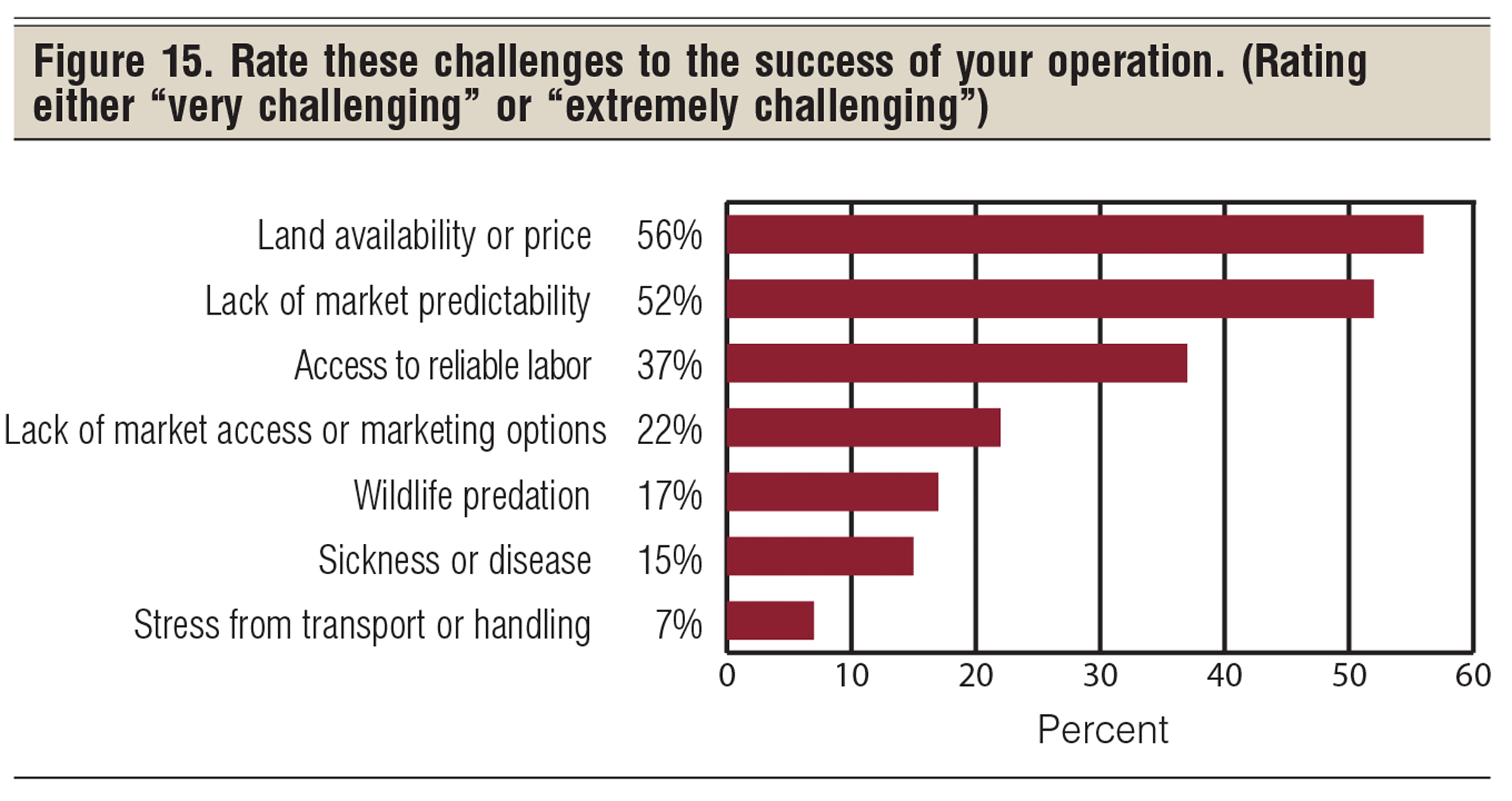

And finally, when asked to rate the challenges to the overall success of their operation, respondents ranked land availability and price at the top of the list, with lack of market predictability coming in second and access to reliable labor identified as the third-biggest challenge. Challenges specifically facing producers on their operation seemed to be more focused on finances than those being faced as an industry, which is no surprise (Figure 15).

BEEF readers, amid challenges with animal health, land prices and volatile markets, seem to be exploring new ways to market their calf crop and add value to their bottom line. Embracing new marketing strategies such as handling and care programs, and trying out management practices such as pain relief methods, may be decisions that producers will be faced with in the future.

However, the resilience of the American cattle producer is unmatched, and BEEF readers will continue to adapt to challenges through value-added marketing and by increasing operation efficiency.

Martin is a master’s degree candidate at Colorado State University, focusing her research on livestock behavior and welfare.

Leave A Comment