The Financial Times recently ran an article titled, “Commodities markets swell in size despite price slide.” The discussion focused on increased commodity open interest at the major futures exchanges in 2017. “Market size has increased by nearly 1.4m contracts in the first nine months of 2017, the most in seven years,” according to the article. Interestingly enough, that’s occurred amidst stagnant commodities prices.

There are any number of explanations for the uptick in open interest. Those include:

- The contrarian bet may be swinging back toward commodities

- Lower prices enable investors to leverage their dollars more effectively

- Reduced volatility translates to less dollars required to meet margin calls.

All of those add up to fund managers increasingly viewing commodities as an alternative investment.

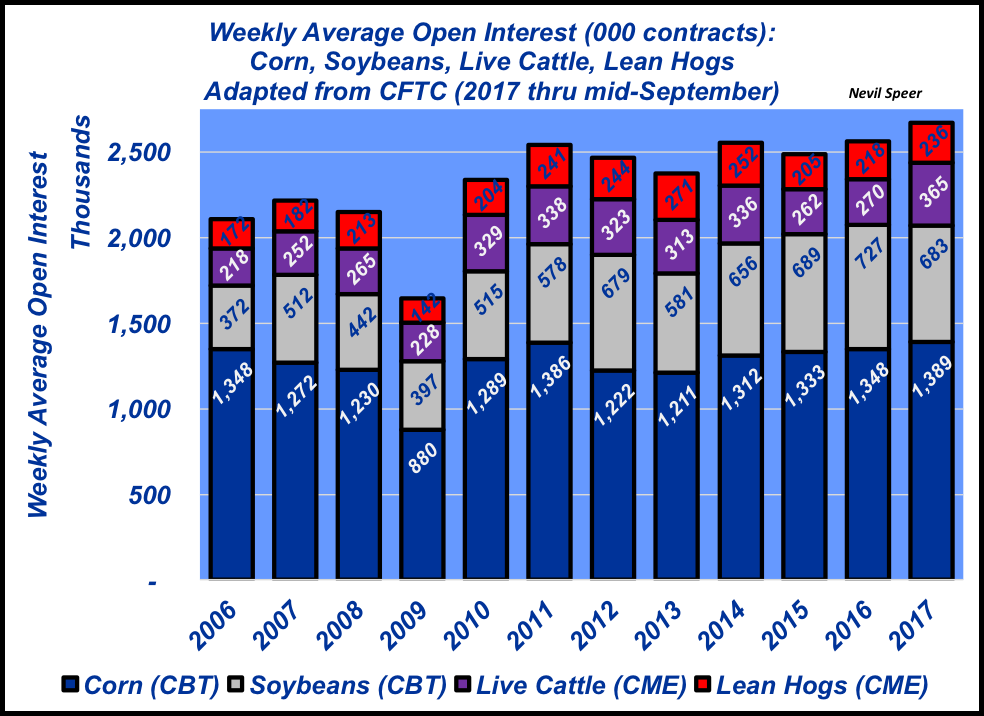

That said, this week’s illustration focuses on four key ag commodities: corn, soybeans, live cattle and lean hogs. The trend described in the Financial Times article appears to be at play in the ag sector. The graph reflects weekly average open interest across the four contracts. This year’s total equals roughly 2.67 million contracts – versus 2.56 million in 2016, despite softer prices across all commodities. Most notably, live cattle trading has experienced a sharp increase in 2017 versus last year.

How do you view these trends? Is this a good sign for agriculture going forward? There’s increasingly a lot of discussion around inflation; do you perceive fund managers using commodity market investment as a hedge against inflation? Are we at the cusp of a new investment cycle in commodities – agriculture included?

Where do you ultimately see prices headed in the next few years? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

Leave A Comment