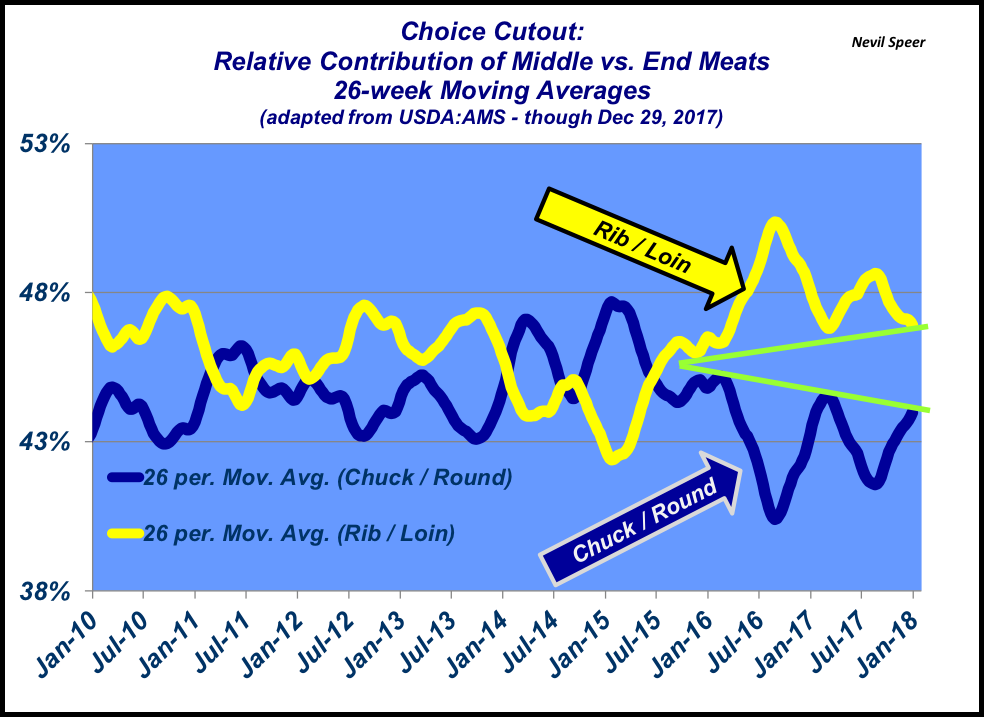

There’s something important going on in the beef market—namely, the relative contribution of middle versus end meats to the overall cutout is diverging.

First, some quick review for context. Around 90% of the cutout is comprised of the four major primals: round, loin, rib and chuck. USDA explains that, “The boxed beef cutout represents the estimated gross value of a beef carcass based on FOB prices paid for individual beef items derived from the carcass.”

In other words, packers report individual item wholesale values based on their respective sales to customers. Those prices are then aggregated by USDA into an index for each primal and then subsequently compiled into an overall cutout value.

This week’s illustration highlights the strong surge in the contribution of the middle meats (rib and loin) that started in early-January 2015. The graph reflects 26-week moving averages to remove some of the weekly noise. That surge peaked late summer 2016. However, as the relative middle-meat contribution waned, the new low marks are almost equal to the longer-running resistance points – hence reflecting the divergence over time.

Based on this data, it appears the rib and loin are finding new pricing power in the marketplace. Stated another way, consumers are clamoring for quality and high-end beef cuts.

As a result, the rib and loin has consistently been deriving a greater portion of carcass value versus the chuck and round. That’s a favorable sign for beef demand and underscores the importance of de-commoditizing beef versus pork and poultry.

How do you perceive this trend? Do you foresee the relative contribution of middle meats versus end meats going back to the longer-run pattern? Or is this a new dynamic in the meat market? Leave your thoughts in the comment section below.

Leave A Comment