Dr. Kenny Burdine, Livestock Marketing Specialist, University of Kentucky

USDA released their January 1 estimates for cattle inventory late last month and I wanted to walk through some of the high points of this report. Beef cow numbers were estimated to have grown by 1.6% from 2017, which is a little less than half the increase that was seen in the prior year. Although growth in the US herd is clearly slowing, beef cow inventory has increased by 9% since 2014.

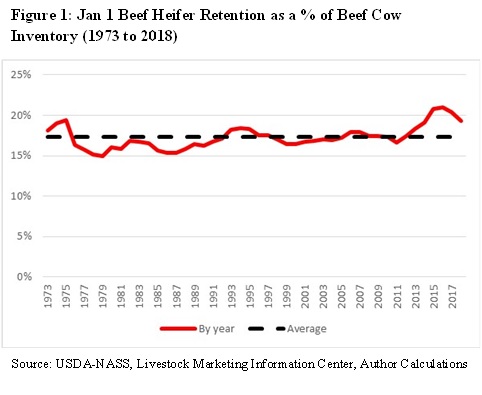

Anytime the beef cowherd is expanding, heifer retention is of interest. Heifer retention for beef cow replacement was estimated to be down 3.7% from 2017. Often a decrease in heifer retention is seen as evidence of future decreases in cow numbers, but that is likely not the case this time. This point is probably best made by considering beef heifer retention as a percent of the total number of beef cows in the US, as shown in figure 1. Heifer retention as a percent of beef cow inventory has averaged 17.3% since 1973 and is depicted by the dotted line. The solid red line shows heifer retention as a percent of beef cattle inventory by year. While this number has decreased from its high of 21% in 2016, it is still well above the long term average. So, while heifer retention is decreasing, it appears that we are still developing a sufficient number of heifers to see herd expansion continue. This really speaks to how high heifer retention was just a couple years ago. The largest change from 2017 was a 7% increase in the number of cattle on feed. Monthly reports (which survey only large feedlots) had been showing cattle on feed number above year-ago levels since spring, but had shown especially large increases since fall. Part of this is due to the size of the calf crop, which was 2% larger in 2017, but I think a larger issue involves winter grazing.

The largest change from 2017 was a 7% increase in the number of cattle on feed. Monthly reports (which survey only large feedlots) had been showing cattle on feed number above year-ago levels since spring, but had shown especially large increases since fall. Part of this is due to the size of the calf crop, which was 2% larger in 2017, but I think a larger issue involves winter grazing.

The annual inventory report also includes an estimate of cattle grazing small grain pasture on January 1st in Kansas, Oklahoma, and Texas. This estimate serves as a gauge of winter grazing, which has a significant impact on late fall and winter calf markets. USDA estimated a 13% decrease in the number of cattle grazing small grains this January as compared to 2017. I had an opportunity to visit with some of my colleagues in Texas and Oklahoma last week and they confirmed that fewer cattle were placed into winter grazing programs this year and some that were placed had to be sold early due to weather challenges. This would suggest that in addition to the larger calf crop, more light cattle were placed directly on feed this winter. Cattle placed on feed at lighter weights will tend to be on feed longer and finish at slightly lower weights.

Still, the combination of growing cattle on feed inventories and relatively inexpensive feed, should translate into a sizeable increase in beef production for 2018. Increases are also expected for both pork and poultry. This growing supply of meat will be the largest challenge for the beef sector in 2018.

The USDA report is summarized in table 1 and the full report can be accessed at: http://usda.mannlib.cornell.edu/usda/current/Catt/Catt-01-31-2018.pdf

| 2017(1,000 hd) | 2018(1,000 hd) | 2018 as % of 2017 | |

| All Cattle and Calves | 93,704.6 | 94,399.0 | 101 |

| Cows and Heifers That Have Calved | 40,559.2 | 41,122.6 | 101 |

| Beef Cows | 31,213.2 | 31,723.0 | 102 |

| Milk Cows | 9,346.0 | 9,399.6 | 101 |

| Heifers 500 Pounds and Over | 20,132.0 | 20,244.8 | 101 |

| For Beef Cow Replacement | 6,368.2 | 6,131.2 | 96 |

| For Milk Cow Replacement | 4,754.0 | 4,7581.3 | 101 |

| Other Heifers | 9,009.8 | 9,332.3 | 104 |

| Steers 500 Pounds and Over | 16,383.5 | 16,352.2 | 100 |

| Bulls 500 Pounds and Over | 2,243.6 | 2,252.2 | 100 |

| Calves Under 500 Pounds | 14,386.3 | 14,427.2 | 100 |

| Cattle on Feed | 13,067.0 | 14,006.4 | 107 |

| 2016 | 2017 | 2017 as % of 2016 | |

| Calf Crop | 35,092.7 | 35,808.2 | 102 |

Source: Ohio Beef Cattle Letter

Leave A Comment