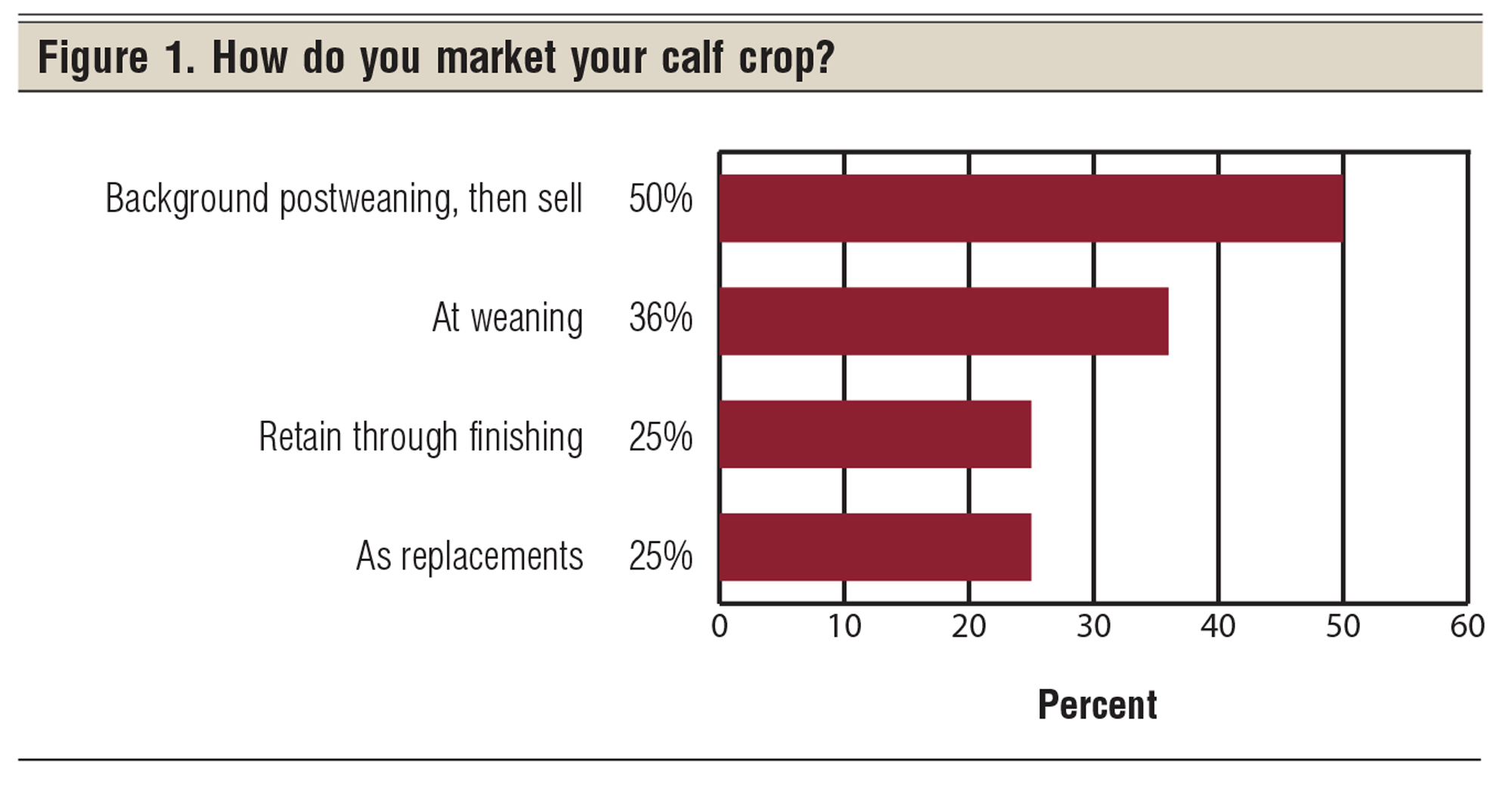

Let’s take a look at some marketing alternatives for 2017 calves. To set the stage, consider a recent BEEF magazine survey question on calf marketing. In summary, 36% of survey respondents sold their calves at weaning. The most popular marketing alternative was backgrounding the calves post-weaning, at 50%. Twenty-five percent retained their calves through finishing (Figure 1).

Each month, as part of my monthly price analysis, I prepare a series of budgets for marketing my eastern Wyoming-western Nebraska study herd’s calf crop through four different calf marketing alternatives. They are:

Each month, as part of my monthly price analysis, I prepare a series of budgets for marketing my eastern Wyoming-western Nebraska study herd’s calf crop through four different calf marketing alternatives. They are:

- Sell calves at weaning in mid-October, with steers weighing 584 pounds and heifers weighing 554 pounds in 2017.

- Background 2017 calves to gain 2.4 pounds per day to 875 pounds; calves are projected to be sold in mid-February 2018.

- Finish background calves in custom lot to 1,300 pounds; calves are projected to be sold in June 2018.

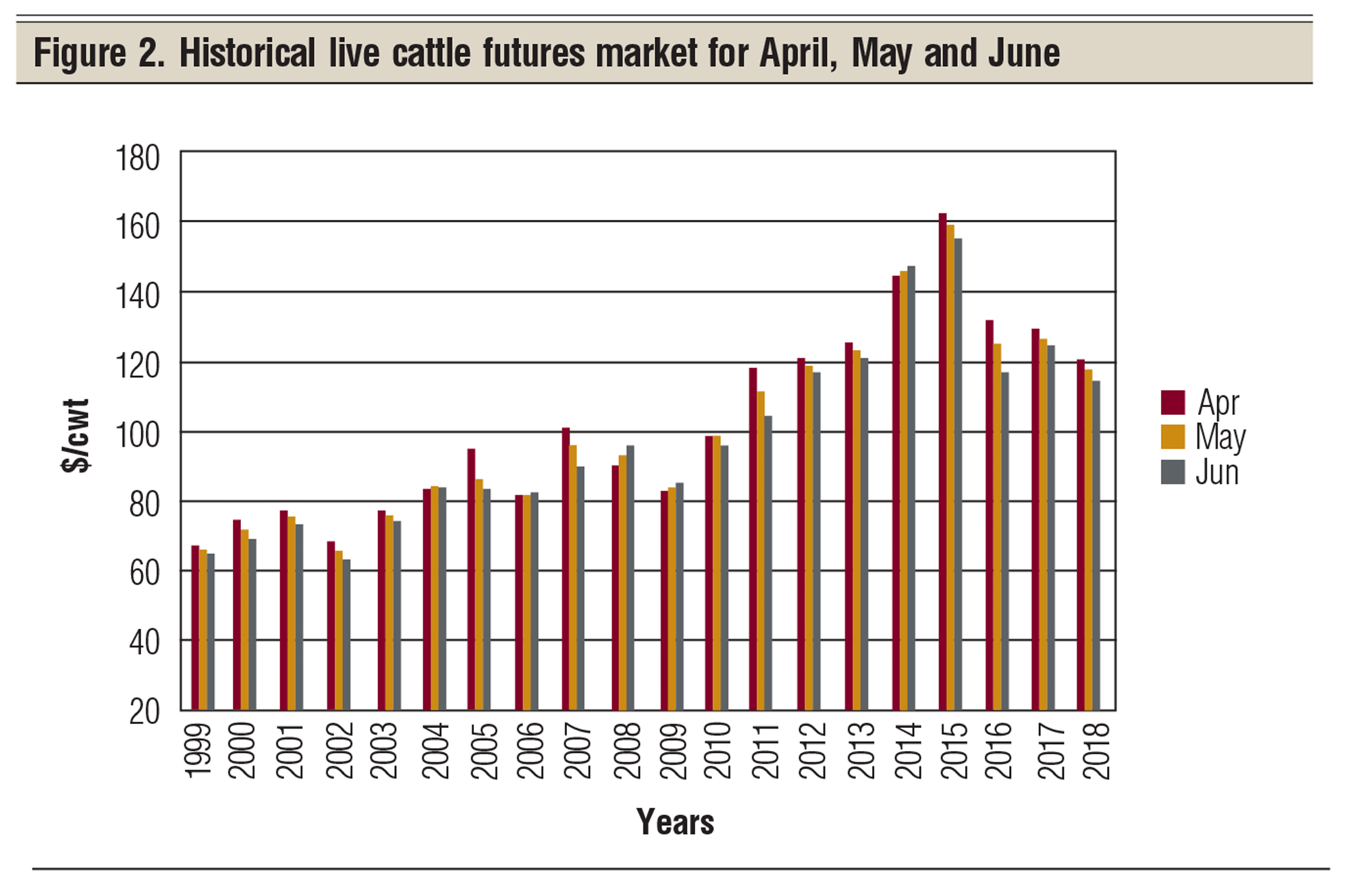

- Retain 2017 calves in a commercial feedlot. Place steers and culled heifers on feed at weaning, selling at 1,300 pounds in mid-May 2018. The key to this marketing alternative is hitting the May market instead of June (Figure 2). It will not be easy to finish 2017 calves in May 2018.

As this is being written, the sell-at-weaning option shows final October 2017 numbers, and the other three marketing options are October 2017 projections.

Selling at weaning in mid-October calculates out to $226 earned returns per cow to unpaid labor, management and facilities. For my study herd, this was considerably better than the $20 that would have been earned if the study rancher had sold at weaning in October 2016. In general, marketing prices are stronger this fall compared to last year. We can attribute some of this increased price to increased beef demand.

This 250-cow study herd exposed 294 females (250 mature cows and 44 virgin heifers) to bulls in the previous year, weaning 256 live calves this fall, for an 87% calf crop. Forty-four replacement heifers have been set aside to be developed. The post-weaning enterprise starts out with 128 steer calves and the remaining 84 heifer calves.

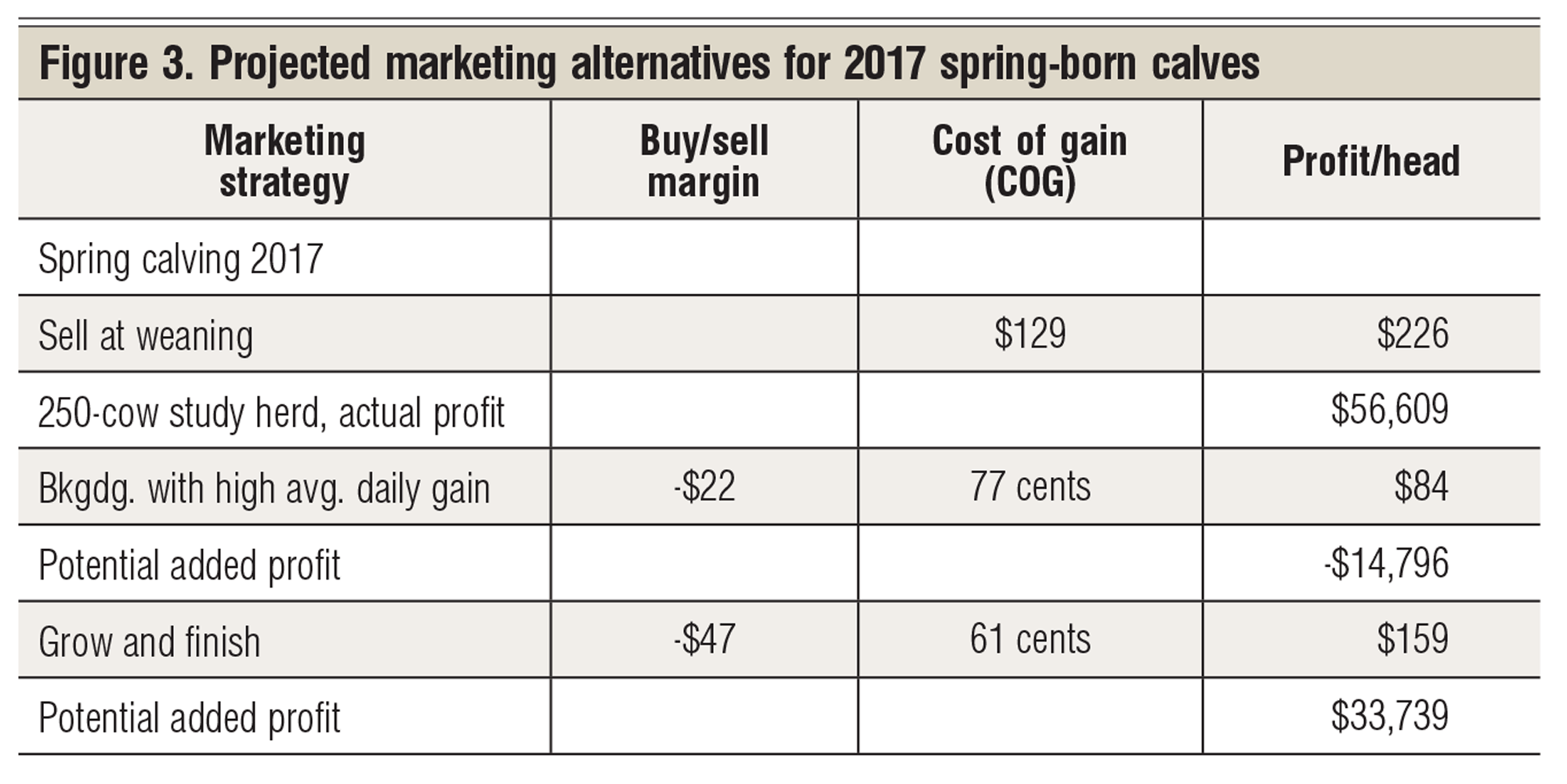

Figure 3 summarizes my October 2017 projected returns from the 250-cow herd, plus the added returns from three post-weaning marketing alternatives. For example, backgrounding the calves on the ranch, with a projected February 2018 market price of $145, generates an added $17,779, or $84 per head, for these 2017 backgrounded feeders.

This $17,779 needs to be added to the beef cow profit of $56,609 to get the accumulated profit from running the beef cow herd and backgrounding the calves, for a total earned net return from the 2017 calves of $74,388, or $298 per cow. For this rancher backgrounding his calves, it is projected that 76% of the net returns will come from running the beef cows. The additional 24% is projected to come from backgrounding.

Finishing the backgrounded calves in a custom lot with a projected June 2018 marketing date is predicted to generate a $70-per-head loss, reducing total herd profit by $14,796. This is predicated on a projected $116 June harvest price.

The grow and finish (retain ownership) marketing option, as of late October 2017, is predicted to earn $33,739 in net income. This is predicated on selling $119 slaughter cattle in mid-May 2018. Coupled with running the cow herd, this projects out to $361 per cow.

This selling price is based on April 2018 futures of $120.87 plus June 2018 futures at $113.82, averaged to a futures price of $117 for May 2018 plus a positive basis of $2.37. Note the $7-per-cwt drop in April 2018 vs. June 2018 Live Cattle futures price. There is considerable risk in this projected marketing alternative. Some form of price protection might be advisable.

Tax implications

The income tax implications of switching marketing programs from year to year can be significant and frequently lock a rancher into a constant marketing program. Let’s review these four marketing alternatives through the current cattle cycle, 2007-17.

My study rancher had always sold at weaning with the exception of last year.

After last year, he asked me to look at some alternative marketing programs over a complete cattle cycle and its resulting prices cycle to see the long-run implication of these different marketing programs.

For the last 15 years or so, I have prepared a budget analysis of a typical eastern Wyoming-western Nebraska beef cow herd. Each month, I update my price databank for sale barn prices, Feeder Cattle futures prices, Live Cattle futures prices, and Corn futures prices. These prices are then used to generate an extensive set of beef enterprise budgets for a typical eastern Wyoming-western Nebraska 250-cow herd.

The first logical number to look at in this 11-year study is the total net income generated over the 11-year period by each marketing alternative.

Running the beef cow herd: The 11-year total accumulative net income for selling at weaning is $1,737 per cow, or an annual average of $158 per cow per year. The range over the 11 years was from a negative $22 per cow in 2008 to a positive $808 per cow in 2014. The only negative return years were 2008 and 2009 — the bottom of the last beef price cycle.

Backgrounding calves: The 11-year total for backgrounding the calves totaled $304 per head, for a $28 per head yearly average. Years 2007, 2008, 2011, 2012 and 2015 were all negative. 2010 and 2016 were big profit years.

The three consecutive years of 2007, 2008 and 2009 averaged minus $32 per head for the three years. A tough, tough time period for backgrounding. Five out of the 11 years generated a negative return.

Finishing background calves: This 11-year period totaled minus $316 per head, giving an annual average of minus $29 per head. This minus average was heavily influenced by two large negative years, 2010 and 2014. Five out of the 11 years were negative, illustrating the problem with harvesting slaughter cattle in June along with a lot of other cattle feeders. The best year was 2016.

Retained ownership: The 11 years averaged $46 per head, for an 11-year total of $507 per head. The largest returns were in 2009 and 2016. The largest loss was in 2014.

Running the cowherd combined with selling background calves: The total 11-year income per cow averaged $2,041 per cow, or $186 per cow per year. On average, this increased total profits by 18% over selling at weaning. 2008 was the only negative year. The downside is that the year-to-year net income variation also increased slightly, implying a little more price risk in this marketing alternative versus selling at weaning.

Running a cowherd with retained ownership through slaughter: The total 11-year profit was $2,244 per cow, generating a an average of $204 per cow per year. On average, this raised the profit per cow by 29%. The high-profit years were 2014 through the projection for 2017. The two negative years were 2007 and 2008. The year-to-year income variation was also less than selling weaned calves.

This data set suggests that retaining calves through slaughter generated 29% more average net income per cow over the 11 years than selling at weaning did, and it had less year-to-year variability.

Both selling backgrounded calves and/or retaining ownership through slaughter should be seriously considered if looking for a single, long-run marketing strategy through a cattle cycle. Stay tuned.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected]

Leave A Comment