Rising Feed Costs Being Felt

– Jeff Lehmkuhler, PhD, PAS, Associate Extension Professor, University of Kentucky

Looking back on 2020, the year had its share of pull your hair out and scream moments. Just as we were nearing the end, another slap in the face came as grain commodities began to run up on the trade market. This is a good thing for our crop growers who struggled in 2020. My brothers-in-law reminded me of this at Christmas how much corn they had already sold earlier in the year for less and how they were now wishing they had held on to it. For those that haven’t looked, the March corn futures in mid-December were in the $4.20’s range and this week were trading in the $5.30’s. It was over the same course of time that the nearby futures for beans went from trading in the mid $11’s to over $14. As most of our feedstuffs in the region are either grain or coproducts of the grain processing industry, these increases in grain commodities have increased feed inputs significantly.

Dr. Burdine continues to share with you market information and you need to stay on top of what’s happening. We can handle increases in grains commodities if cattle prices follow the same pattern. The February fed cattle futures started following that trend in December but have since come right back to mid-December prices near $112. What happens to those feeder cattle futures when grain inputs go up and fed cattle drop? You guessed it; the January feeder calf contract is trading $4 lower than it was in mid-December. However, some say things will turn around soon making mid-2021 a bit better than it seems to be starting off.

Let’s just quickly think about these feed costs. Run your budgets and see what the rise in feed and steady-to-lower calf prices does to your breakeven. The optimism in the markets seems to suggest that using some of that excess hay to background calves may be something to consider as the Aug/Sept futures are much stronger than March. Work out your value of gain and see whether this fits into your operation. Consider risk management options on feeders.

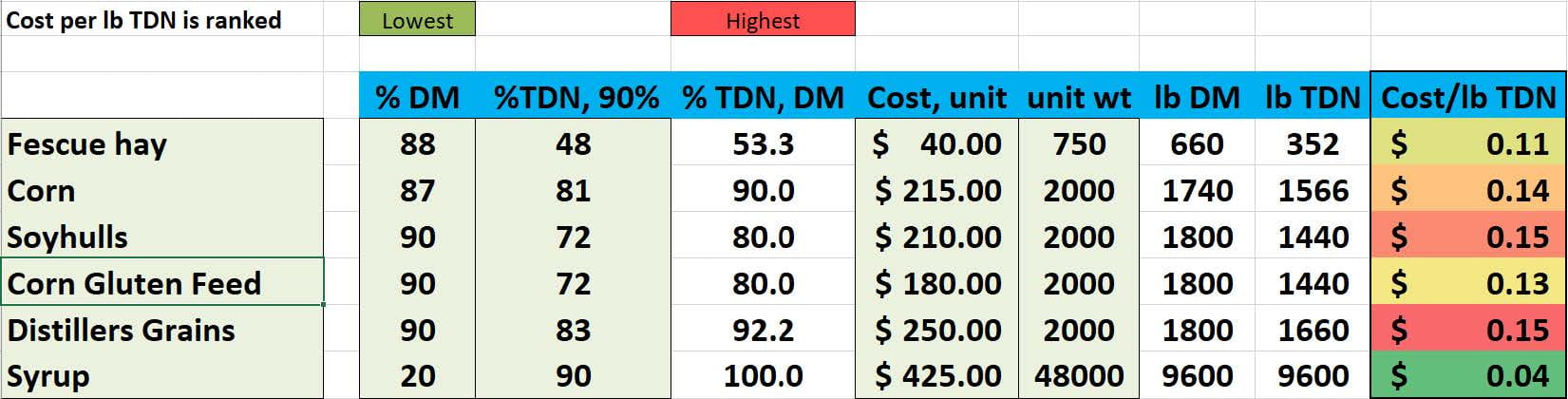

Test your forages to find out what you may need to supplement the cow herd and how to best use that excess forage in the grower programs. Those in the bourbon producing areas may find this year the time to look at using stillage or syrup to supplement cows and growing calves. In most cases, this feed will be a better value compared to the higher priced commodities if you can get it delivered and figure out a way to feed with troughs.

In many cases with cows, we are short energy or calories. Shop around for the best value. As an example, look at the table included. Considering the differences in prices and calculating the cost per pound of TDN will allow you to make an informed decision on the best value. That said, most coproduct feeds are going to be priced based on the grain commodities. It is finding that bargain which can be a challenge and for those in the bourbon producing areas it very well may be stillage or syrup.

Lastly, apply technology to help with efficiency. If you are going to be supplementing cows and calves with a grain mix, consider using an ionophore to get a bit more energy from the feeing program. Those backgrounding calves, unless you are guaranteed a premium for not doing so, implant the steers and market heifers as it continues to be a solid return on investment. And tipping my hat to Dr. Higgins, keep the cattle out of the mud to avoid throwing dollars on the ground from lost performance and reduced efficiency.

Greener grass is coming. We hope to continue to see you on our virtual meetings and until we see each other in person, stay healthy. Reach out to your Extension agent for additional information and resources.